Crypto Tax Revenue Reaches IDR 1.71 Trillion by September 2025

Indonesia's tax authority reports crypto tax revenue of IDR 1.71 trillion through September 2025, split between income tax (PPh 22) and VAT,

Last updated:

Indonesia's tax authority reports crypto tax revenue of IDR 1.71 trillion through September 2025, split between income tax (PPh 22) and VAT,

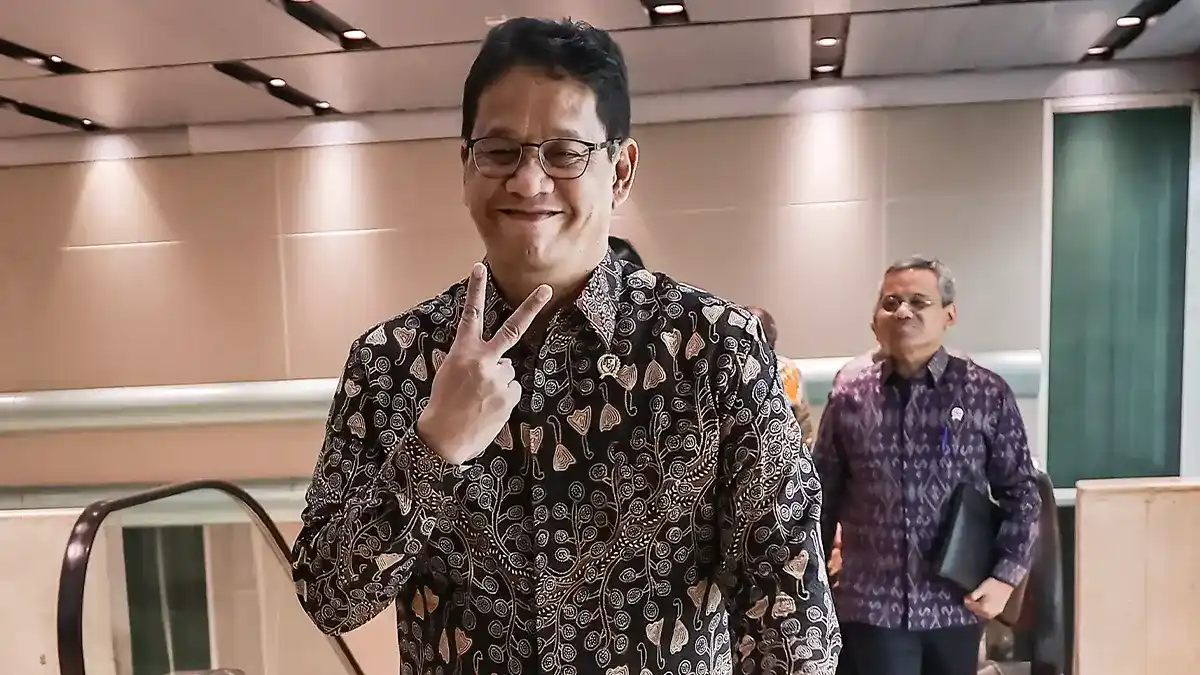

Director General of Taxation Bimo Wijayanto heard film producers’ concerns about high taxes and pledged a scheme to support local film production.

DJP recorded 172,000 HWI tax returns for 2024, with 20.1 percent filed late. A 35 percent rate applies to income over IDR 5 billion, with penalties of

Tax office in Klaten seized six vehicles (three motorcycles, one car, two trucks) over Rp2.67 billion in taxes; assets are sealed, auctioned if

The government formed a Task Force with work groups to optimize national programs, including the 8+4+5 Economic Package, 2026 stimulus, and free

Finance minister speeds up Coretax upgrades to finish by late October 2025, easing SP2DK submissions and helping taxpayers avoid compliance delays.

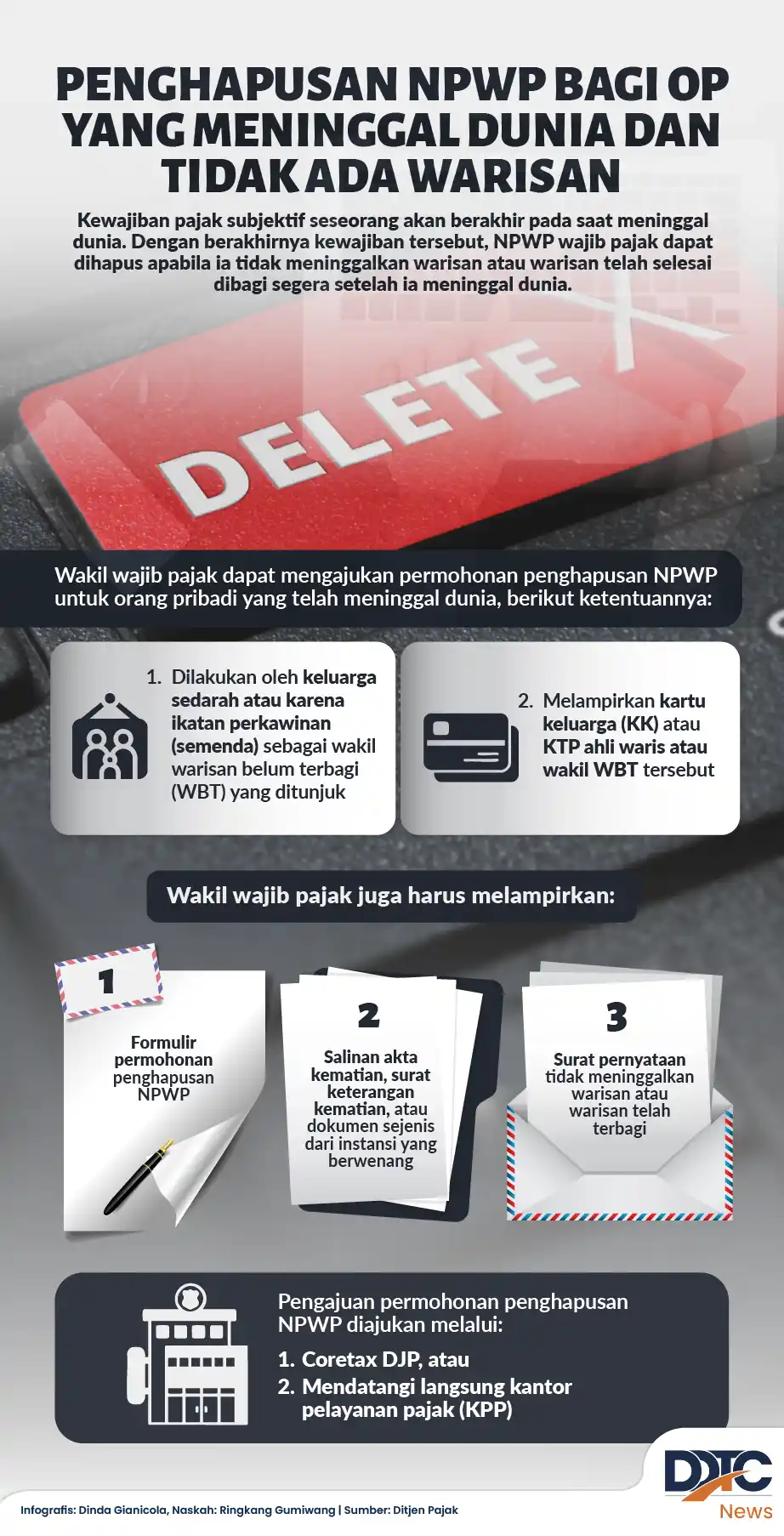

The Directorate General of Taxes will delete tax IDs of deceased individuals without heirs, so the numbers are no longer active in the tax registry.

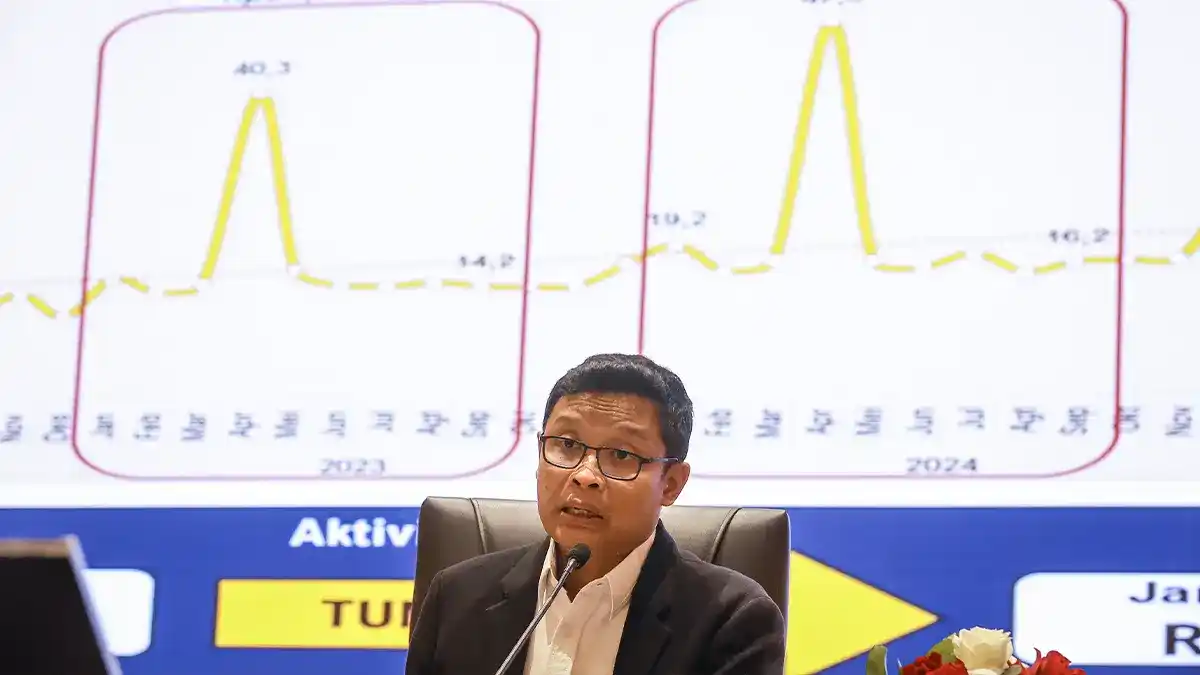

Indonesia’s tax authority is stepping up oversight of taxpayers as the year ends, using micro‑management to map high‑potential cases and close gaps.

Belawan Customs has activated the e‑Seal system, a tag that tracks containers in real time to speed up export‑import clearance and curb violations.

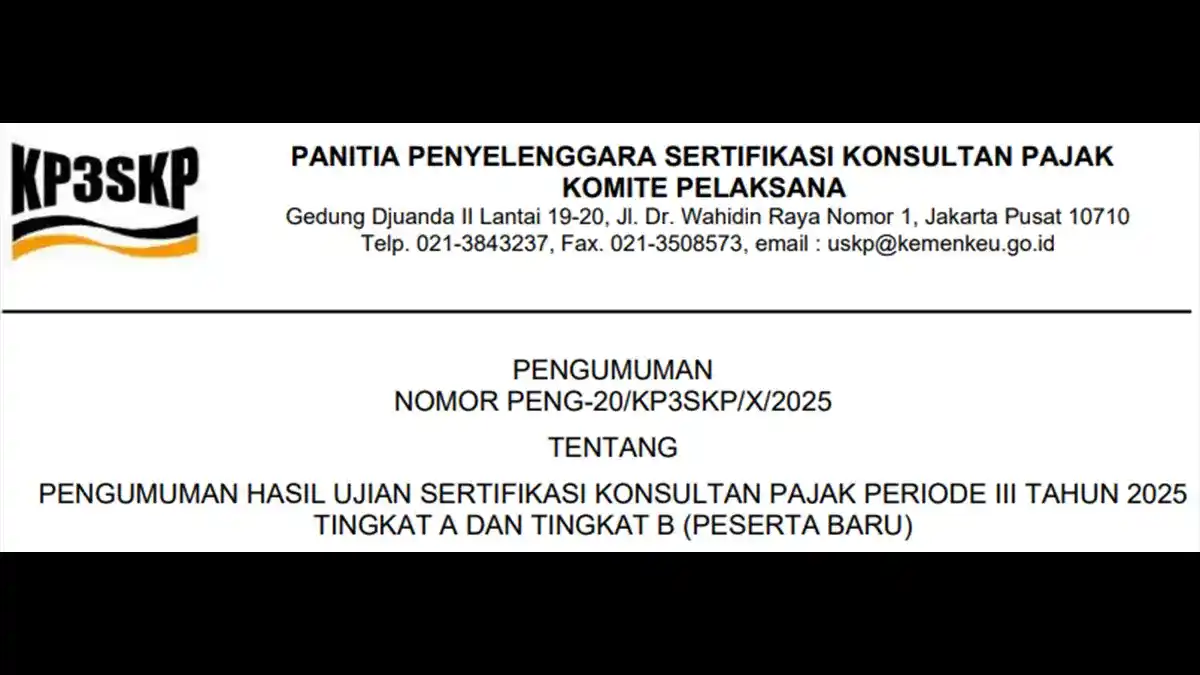

KP3SKP announced USKP results for period III 2025, with 314 Level A and 273 Level B candidates passing, plus details on retakes and penalties.

Finance Minister Purbaya earmarks Rp20 trillion to clear all BPJS Health contribution arrears, urging better management and AI-driven claim checks.

Banyuwangi’s regional tax office launched a compliance operation with the prosecutor’s office, local tax office and Satpol PP, focusing on