Finance Ministry Tightens Tax Audits on High‑Wealth Individuals

Finance Minister Purbaya Sadewa warned high‑wealth individuals (HWI) are on a monitoring list and may face audits or sanctions if they do not comply.

Last updated:

Finance Minister Purbaya Sadewa warned high‑wealth individuals (HWI) are on a monitoring list and may face audits or sanctions if they do not comply.

Tax Authority will monitor SME business-splitting via a joint database with Finance and Law ministries, develop a single‑window financial reporting

Jakarta provincial government warns that the zero‑percent tax rate for motor vehicle tax and transfer fee on electric cars, effective until Dec 31

PPh Final is a withholding tax applied at receipt, not listed among the six tax categories, and is treated as a final tax on dividends or royalties.

The Directorate General of Taxes reports tax collection of Rp42.53 trillion up to September 30 2025, including e‑commerce VAT, crypto, fintech and

Tax Director Bimo Wijayanto warned that UMKMs with annual turnover above Rp4.8 billion should not split their businesses to benefit from the 0.5%

Airlangga Hartarto reports KUR up to 17 Oct 2025 reached Rp217.20 trillion (76.8 percent target) 3.69 million borrowers and 2.28 percent NPL

Finance Ministry under Minister Purbaya Sadewa issued Regulation No. 67/2025 imposing a cotton‑yarn duty of Rp7.5k‑Rp7.3k per kg, exempting 120 WTO

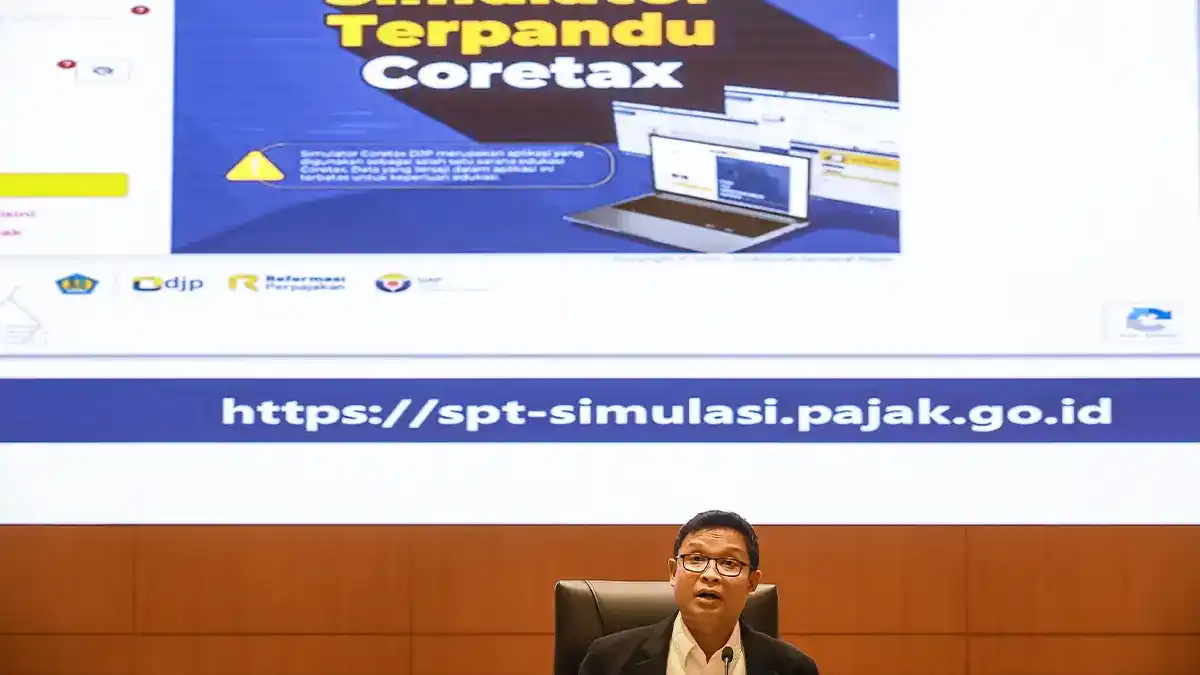

Indonesia's tax authority urges 129 PR staff from 68 ministries to activate Coretax accounts and register codes, a step to file 2025 tax returns.

Bank credit grew 7.7% YoY Sep 2025 despite placing Rp200 trillion in five state banks. BI will issue liquidity incentives in Dec to spur credit.

Finance Minister Purbaya placed Rp200 trillion in five state banks, yet September 2025 bank credit grew only 7.7% YoY, DPK rose 11.18% and BI plans

Finance Minister Purbaya Yudhi will announce the Coretax system fix results on Friday, after an external IT team addresses bugs that have slowed tax