Prabowo: Tax Revenue Should Finance Public Services and KRL

President Prabowo Subianto says tax revenue must fund public services and approved adding 30 KRL train sets with a budget of IDR 5 trillion.

Last updated:

President Prabowo Subianto says tax revenue must fund public services and approved adding 30 KRL train sets with a budget of IDR 5 trillion.

Indonesia's Ministry of Finance is developing an IT‑based Tax Control Framework (TCF) to improve tax compliance, piloting it with firms next year.

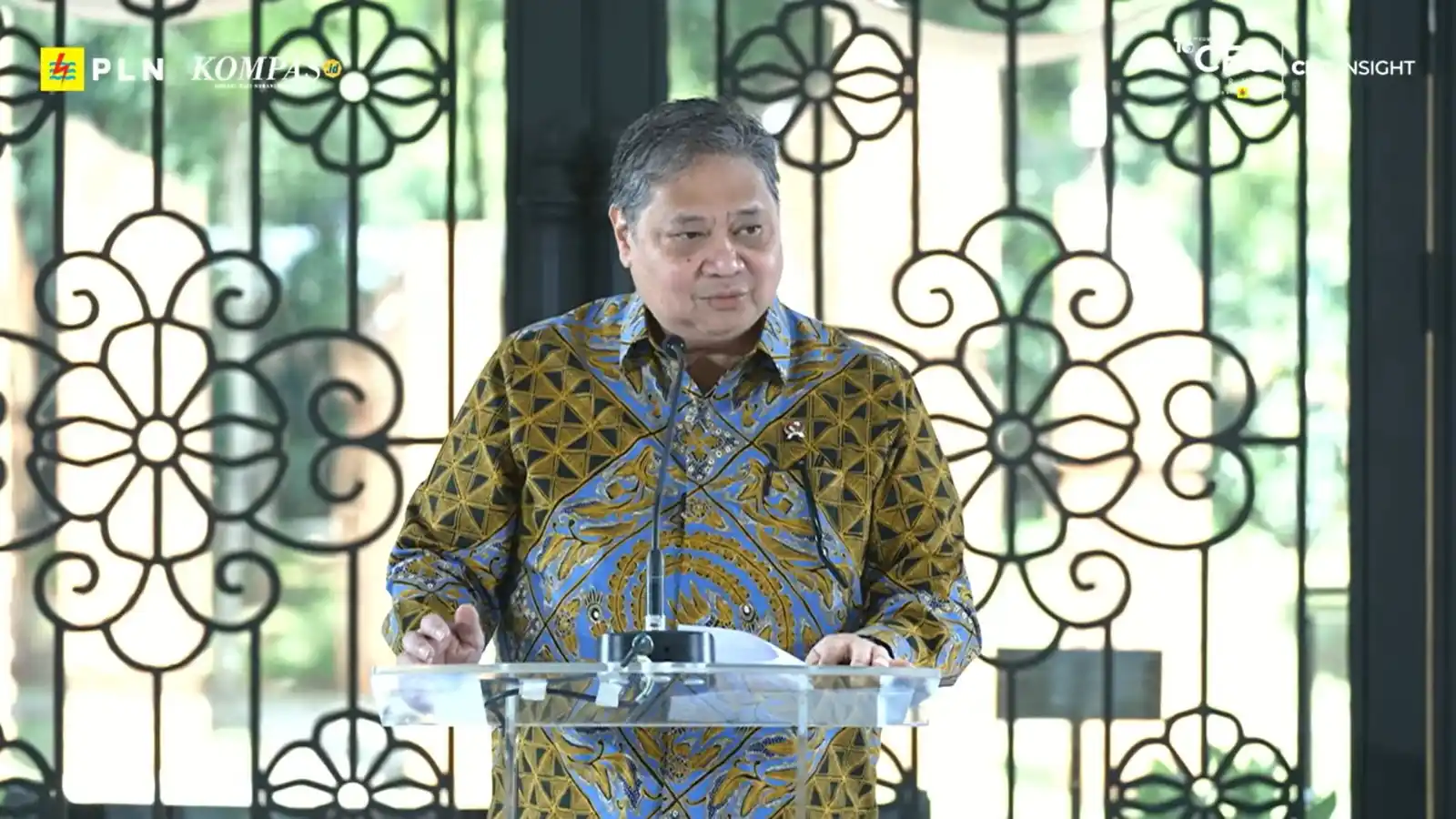

Economy Minister Airlangga Hartarto urges businesses to use supertax deduction PMK 81/2024, 300 % R&D and 200 % training cuts, use accounting firm.

The Directorate of Taxes cabut faktur bagi PKP melanggar kriteria PPh: tidak memotong pajak 3 bulan, menyampaikan SPT, atau melaporkan bukti potong.

OJK said Himbara banks improved after the government placed 200 trillion rupiah, with loan growth of 8.62% and deposits rising 12.89%.

Karawang regent Aep Syaepuloh announced on 4 November 2025 that the Land and Building Tax (PBB) will not increase, citing economic pressure and

The article explains bias survivorship in tax data that makes authorities focus on taxpayers who already file, while non‑filers pose compliance risk.

From 22 Oct 2025, PER‑19/PJ/2025 authorises the Director General to deactivate PKP status for taxpayers who fail reporting, withholding or have

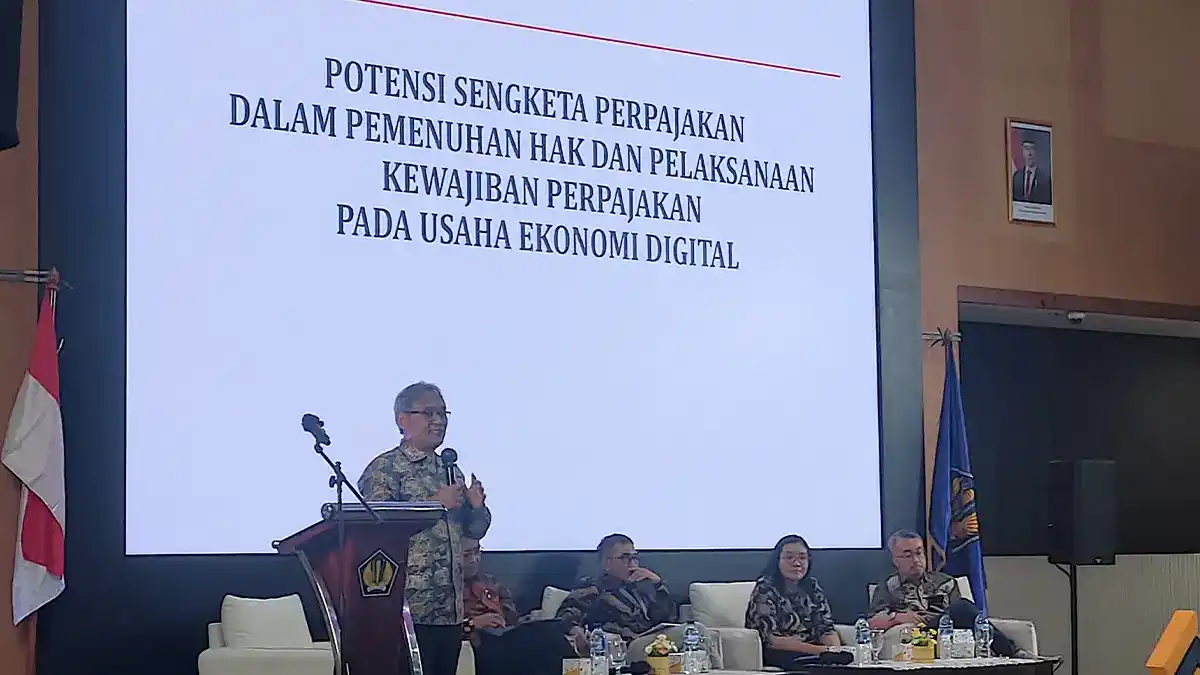

The Tax Court outlines 13 potential tax disputes, covering VAT and income tax, that may arise from Indonesia’s digital economy regulations.

The Ministry of Tourism introduced the #DiIndonesiaAja holiday campaign together with a 6% PPN DTP exemption for air tickets and transport fare cuts

Finance Minister Purbaya Yudhi Sadewa said Indonesia’s financial system remained stable in Q3 2025, backed by consumer spending and a trade surplus.

DJP Director Hestu Yoga Saksama says marketplace tax rules are set by the Tax Law, Art. 32A Fiscal Law and PMK 37/2025, but appointment is postponed.