Finance Minister Purbaya Says Indonesia to Grow 5.5 Percent 2025

Finance Minister Purbaya says Indonesia’s economy will grow 5.5 % in Q4 2025, citing financial stability and IMF’s growth outlook.

Last updated:

Finance Minister Purbaya says Indonesia’s economy will grow 5.5 % in Q4 2025, citing financial stability and IMF’s growth outlook.

The Ministry for Economic Affairs asked the US to cut the duty on palm oil, cocoa and rubber to zero, with talks after APEC summit in November 2025.

Bank Indonesia said foreign‑exchange reserves reached $148.7 billion by September 2025, enough to cover six months of imports and external debt

Finance Minister Purbaya Yudhi Sadewa said the allocation of Rp200 trillion to state‑owned banks via Himbara has raised economic liquidity, reflected

Finance Ministry outlines challenges in taxing the economy—nexus, profit allocation, and transaction administration—and a tax collection system.

The B Commission of Yogyakarta DPRD reviews 2026 revenue, finds inconsistent taxpayer data across agencies, and urges a database to boost autonomy.

The Industropolis Batang Special Economic Zone secured Rp456.76 billion in new investment from six firms, attracted by tax incentives such as a tax

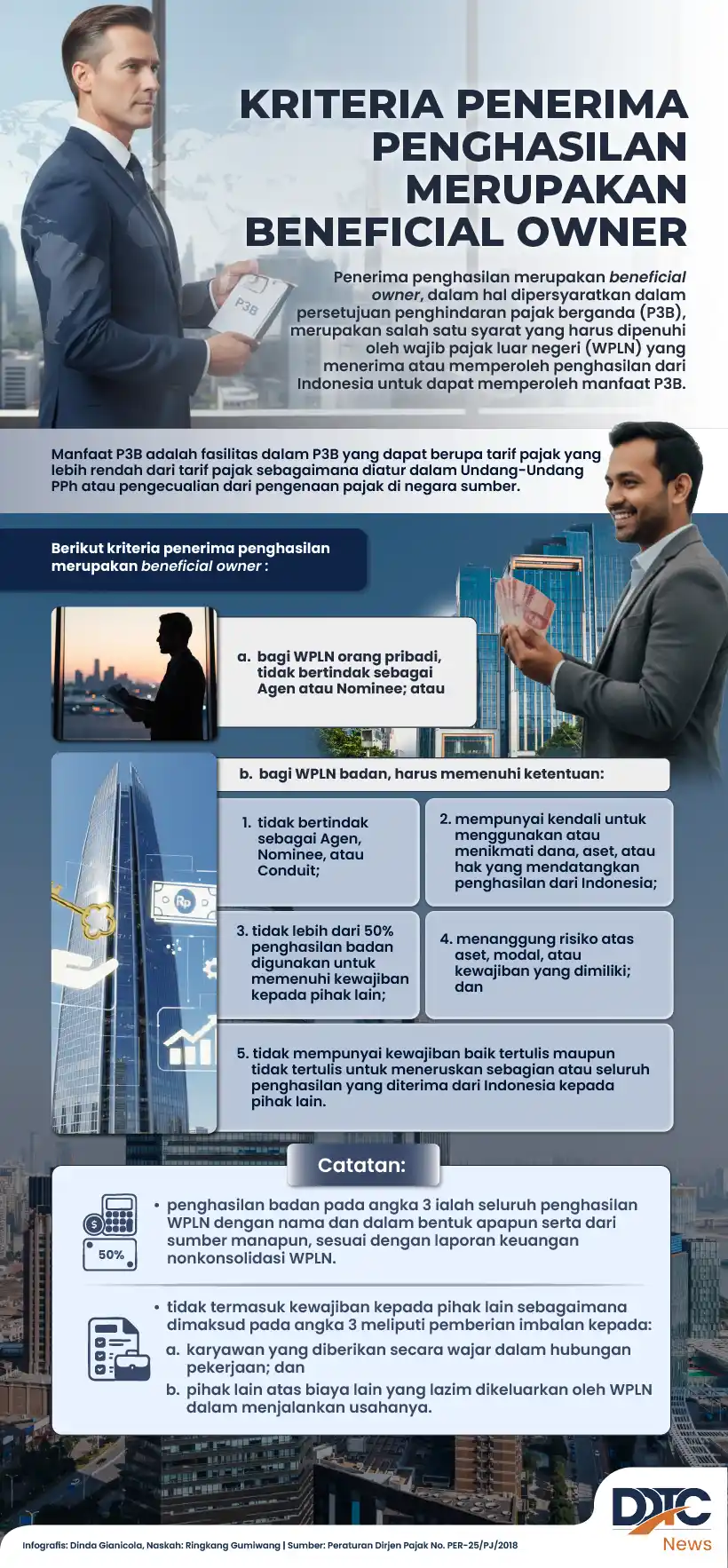

The Directorate General of Taxes issued guidelines defining criteria for a beneficial owner of income, including shareholding, profit rights, and

Indonesia's Customs granted an ATA Carnet, an international ‘goods passport’, letting Blackpink’s concert gear enter GBK without import duties.

The West Kalimantan Tax Office and Pontianak Financial Training Center released a tax pocket guide and electronic manual to help village treasurers

On 30 October 2025, KPP Majene held a Tax Corner at RSUD Hajjah Andi Depu, 240 staff activated Coretax accounts and obtained DJP codes.

Kazakhstan will require foreign firms in its digital market to register as VAT collectors from 1 January 2026, with the rate set at 16% and firms