Luhut Commends Treasury’s Rp200 Trillion Deposit into State Banks

Luhut Binsar Pandjaitan praised Finance Minister Purbaya for placing Rp200 trillion into five state-owned banks to support economic growth.

Last updated:

Luhut Binsar Pandjaitan praised Finance Minister Purbaya for placing Rp200 trillion into five state-owned banks to support economic growth.

PMK No 15/2025 shortens tax audit periods to five months, creating new compliance challenges for companies, especially in transfer‑pricing audits.

West Jakarta Tax Office tightens oversight of firms using virtual offices, coordinating with DJP Jakarta to ensure tax compliance and clear addresses.

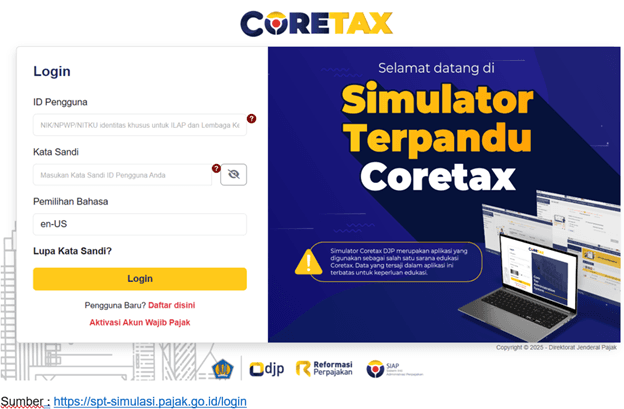

The Directorate General of Taxes launches the Coretax Simulator, an app accessible with an ID number, with sample data for corporate tax filing.

DPR proposes revising P2SK law to add oversight of Bank Indonesia, OJK and LPS, appointment unchanged; markets fear pressure may erode independence.

Ahead of the 2025 MUI Congress, the Indonesian Tax Office and MUI met to draft a fair‑tax fatwa, aligning tax obligations with Islamic principles.

Indonesia’s PMK 169/2015 sets a 4:1 debt‑to‑equity limit on interest deductions, aiming to curb tax avoidance and provide certainty for corporations.

Tax Inclusion Program, a joint effort of the Tax Authority and the Ministry of Education, adds tax topics to curricula from elementary to university

Finance Minister says APBN will not fund family offices; Luhut states investors must finance them and the government will ensure fund security, with a

Indonesia has a network of P3B tax treaties that avoid double taxation. To get reduced rates, submit SKD DGT and meet substance and anti‑abuse

Sumatra DPRD visited Central Java to learn how tax (PAP) can raise revenue. Bapenda says PAP receipts hit Rp18.99 billion in 2024, 0.19 % of PAD.

DEN chair Luhut Pandjaitan said the family office will be funded by investors, not the budget, and will get tax incentives to attract capital to