Prabowo Urges Stronger UMKM Empowerment at APEC Korea

President Prabowo Subianto urged APEC members in Gyeongju, South Korea, on 31 Oct 2025 to strengthen SMEs by expanding digital access and growth.

Last updated:

President Prabowo Subianto urged APEC members in Gyeongju, South Korea, on 31 Oct 2025 to strengthen SMEs by expanding digital access and growth.

Israel announced a tax reform cutting the rate on carried interest to 27% and exempting VAT and capital‑gain taxes to attract technology investors.

The agency reported consumer price inflation in October 2025 rose to 2.86 percent year‑on‑year, up from 2.65 percent in September, driven by red chili

Indonesia's DJP Jakarta Central disclosed a 58.2 billion rupiah money‑laundering case involving taxpayer TB, detailing asset seizures and multi‑agency

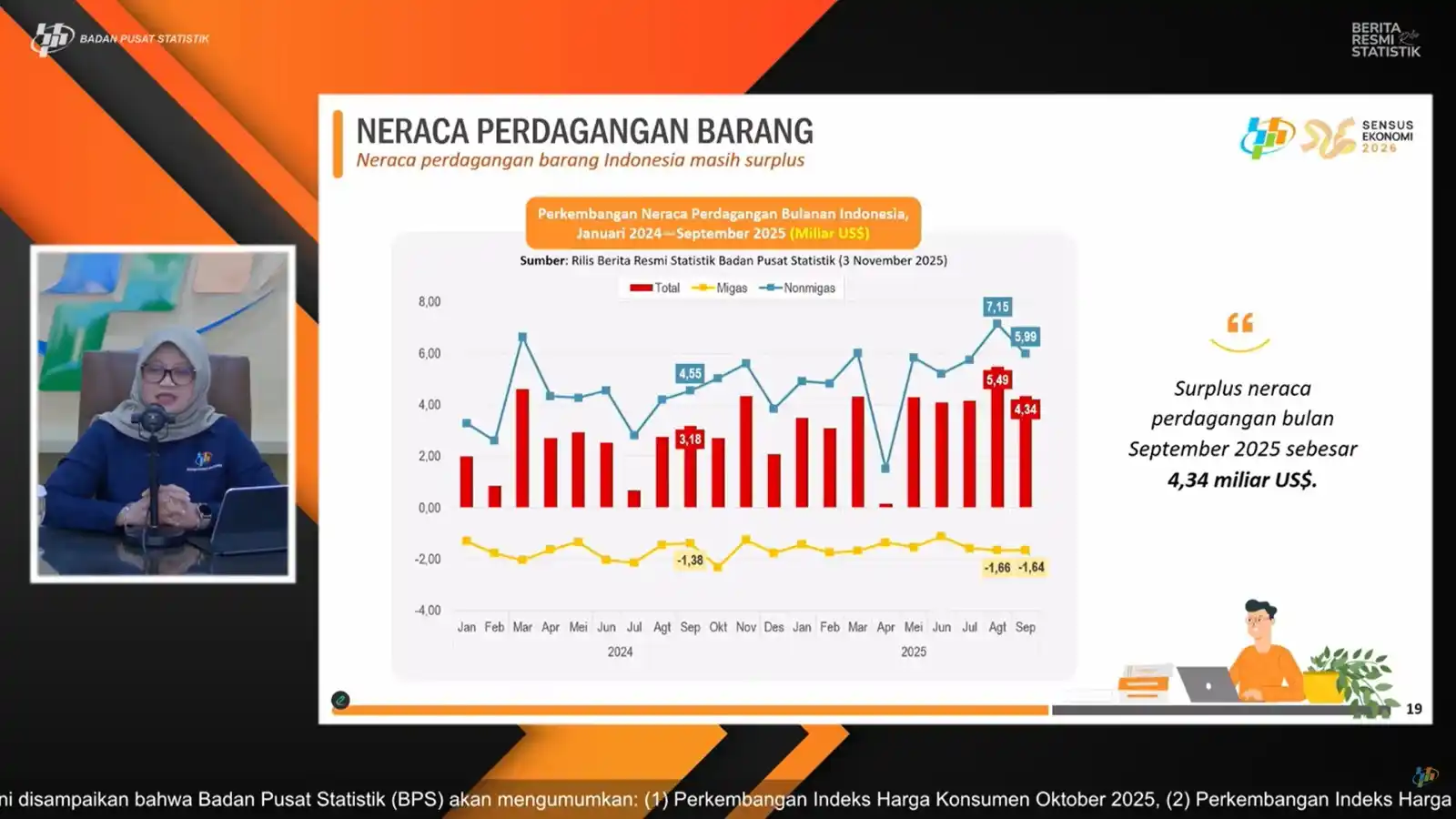

BPS reports Indonesia’s September 2025 trade surplus of US4,34 billion, with exports of US24,68 billion and imports of US20,34 billion.

Palembang City launches tax waiver and PBB-P2 discount Nov 2‑Dec 30 2025, 100 % reduction, 50 % discount for 2020‑2024, and waives penalties for 10

DJP Jaksus trained 1,200 taxpayers on Coretax account activation and SPT filing simulation, supporting the tax authority’s digital transformation.

The Tax Consultant Certification Committee added extra slots for retaking candidates of USKP levels B and C, allowing 1,655 and 245 registrants to sit

The Ministry of Finance set monthly interest rates for tax penalty calculations and interest refunds for 1–30 November 2025, ranging from 0.51% to

The USKP B and C re‑examination will be held 1–3 December 2025 in 13 cities, with registration opening this week via the official portal.

Tanjungpandan Customs eliminated 50,244 illegal cigarettes and 24 L of illicit alcoholic drinks valued at Rp80.143 million, averting a loss of

FEB UI and DDTC host a National Tax Seminar 17 Nov 2025, discussing cooperative compliance, with the Director General of Taxation as speaker.