National Internship Wave Two Reopens, Stipend Tied to Minimum

The government opens registration for the second wave of the national internship program (6‑12 Nov 2025) for 80,000 graduates, with a stipend equal to

Last updated:

The government opens registration for the second wave of the national internship program (6‑12 Nov 2025) for 80,000 graduates, with a stipend equal to

The Transport Ministry will lower domestic flight fares from 22 Dec 2025 to 10 Jan 2026, cutting VAT, fuel surcharges and service fees to improve

Malaysia Parliament member Hassan Karim urges the government to impose a wealth tax on millionaires to boost state revenue.

Jakarta’s provincial government has extended the PBB-P2 tax incentive to 31 December 2025, offering up to a 50 % reduction on principal and waiving

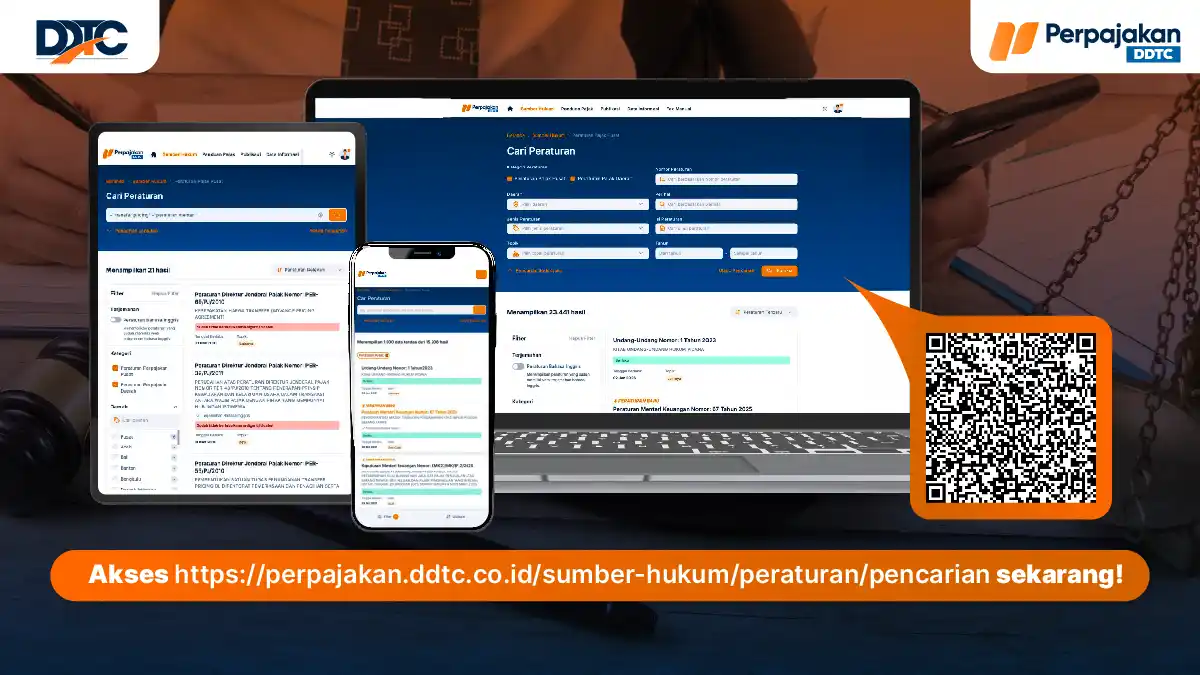

DDTC upgraded its tax platform with simple and advanced search, PDF access, and a responsive interface to streamline retrieval of regional tax rules.

PER-19/PJ/2025 outlines six criteria that can block a PKP’s electronic invoice creation access and sets a clarification process to restore the right.

Tax experts say advance ruling needs legal framework, covering response time limits and required documentation, to strengthen Indonesia’s tax system.

President Javier Milei announced the removal of 20 taxes and a labor reform to boost formal employment and simplify Argentina’s tax system.

The Directorate General of Taxes details how to add an individual without NPWP but with NIK as the Person in Charge (PIC) for a Coretax account.

Updated data for additional BLT cash assistance covers 35.04 million families; 3.5 million are deemed ineligible and will be replaced with qualified

Taxpayers can update their main address via Coretax DJP by uploading a KTP photo PDF; the system automatically sends a receipt to the account and

Italy will raise flat tax for wealthy individuals from €200,000 to €300,000 and for family members from €25,000 to €50,000 in the 2026 tax year.