DJBC Visits Liquor and Vape Factories for Customs Assistance

DJBC conducted a CVC visit to a liquor producer in Tabanan and a vape maker in Purwokerto on 3 Nov 2025 to ensure tax compliance and assist.

Last updated:

DJBC conducted a CVC visit to a liquor producer in Tabanan and a vape maker in Purwokerto on 3 Nov 2025 to ensure tax compliance and assist.

BPS reports monthly inflation of 0.28 percent in October 2025 and annual 2.86 percent. Increases come from services, gold jewelry, and price gaps.

Finance Minister Purbaya awarded 9 tax officials and 8 customs officers for securing state revenue and cracking illegal clothing and cigarette trade.

DDTCNews increased winners of its article contest to 40 after 458 entries. Prize money rose to 85 million rupiah and the works will be in a 2025 book.

The Ministry of Finance issued KMK No 8/MK/EF/2025 setting progressive tax penalty interest rates of 0.51‑2.17% per month for 1‑30 November 2025 and a

Finance Minister Purbaya Yudhi Sadewa said the state’s Rp200 trillion in BUMN banks must fund loans, not SBN purchases, with penalties for

DDTCNews said 90 entries of the 2025 tax writing contest are now under jury review from Nov 3‑10; 40 winners will be revealed on Nov 17.

The Finance Ministry reports that additional direct cash assistance (BLT) amounting to Rp18 trillion has been distributed to low‑income families,

TaxPrime’s Bobby Savero says the use of an alternative tax base (DPP) for VAT calculations complicates data analysis, making oversight by the

The North Sumatra Tax Office urges taxpayers not to click suspicious Coretax DJP links or download fake apps, to protect personal and tax data.

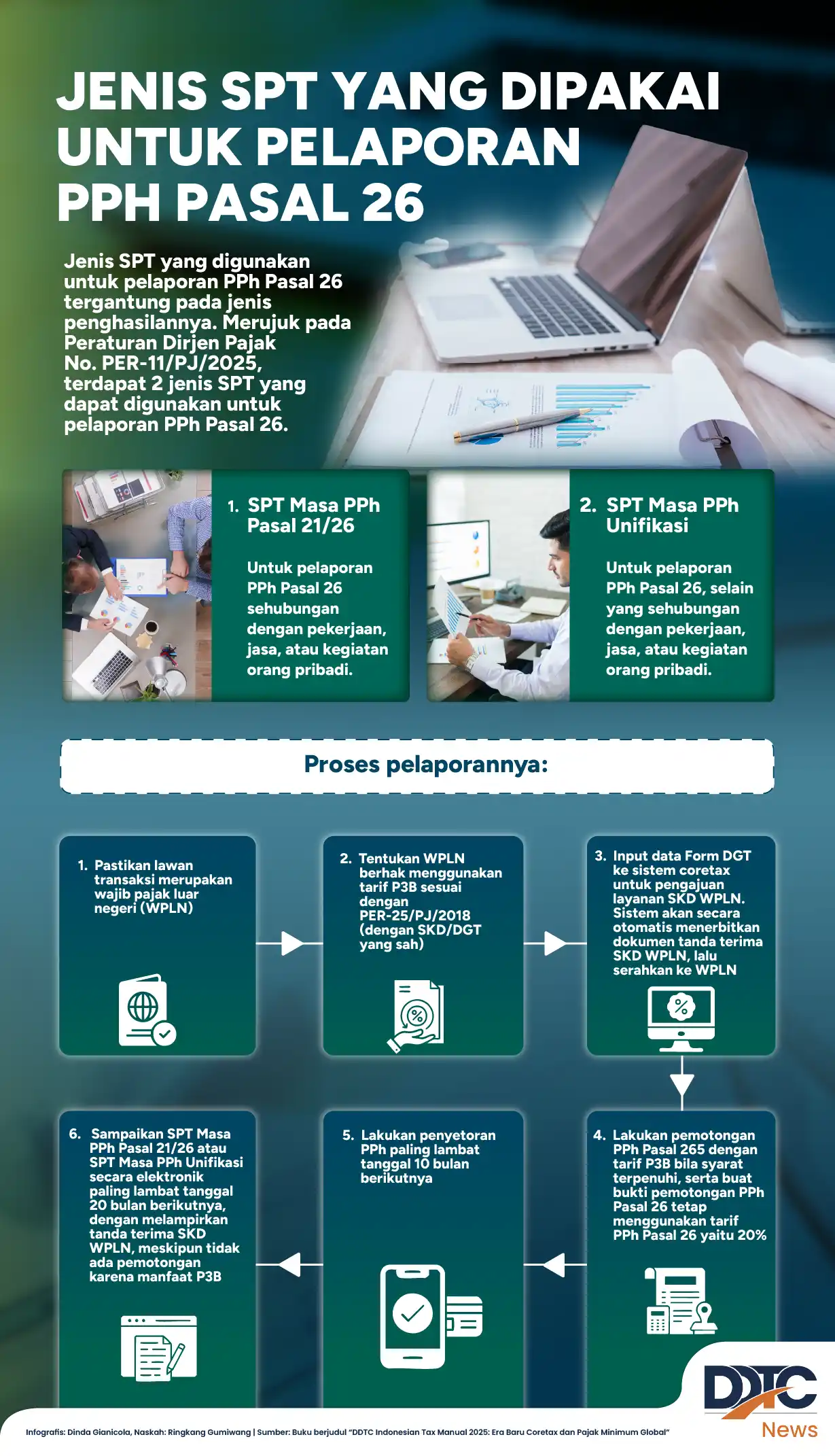

PPh Article 26 reporting requires monthly SPT Masa (Form 1770‑1) and an annual SPT Tahunan (Form 1770‑2), each detailing withholding transactions and

VAT rises to 12% for luxury goods in 2025, but tax base set at 11/12, so effective rate stays at 11%. Tax code changes get three‑month transition.