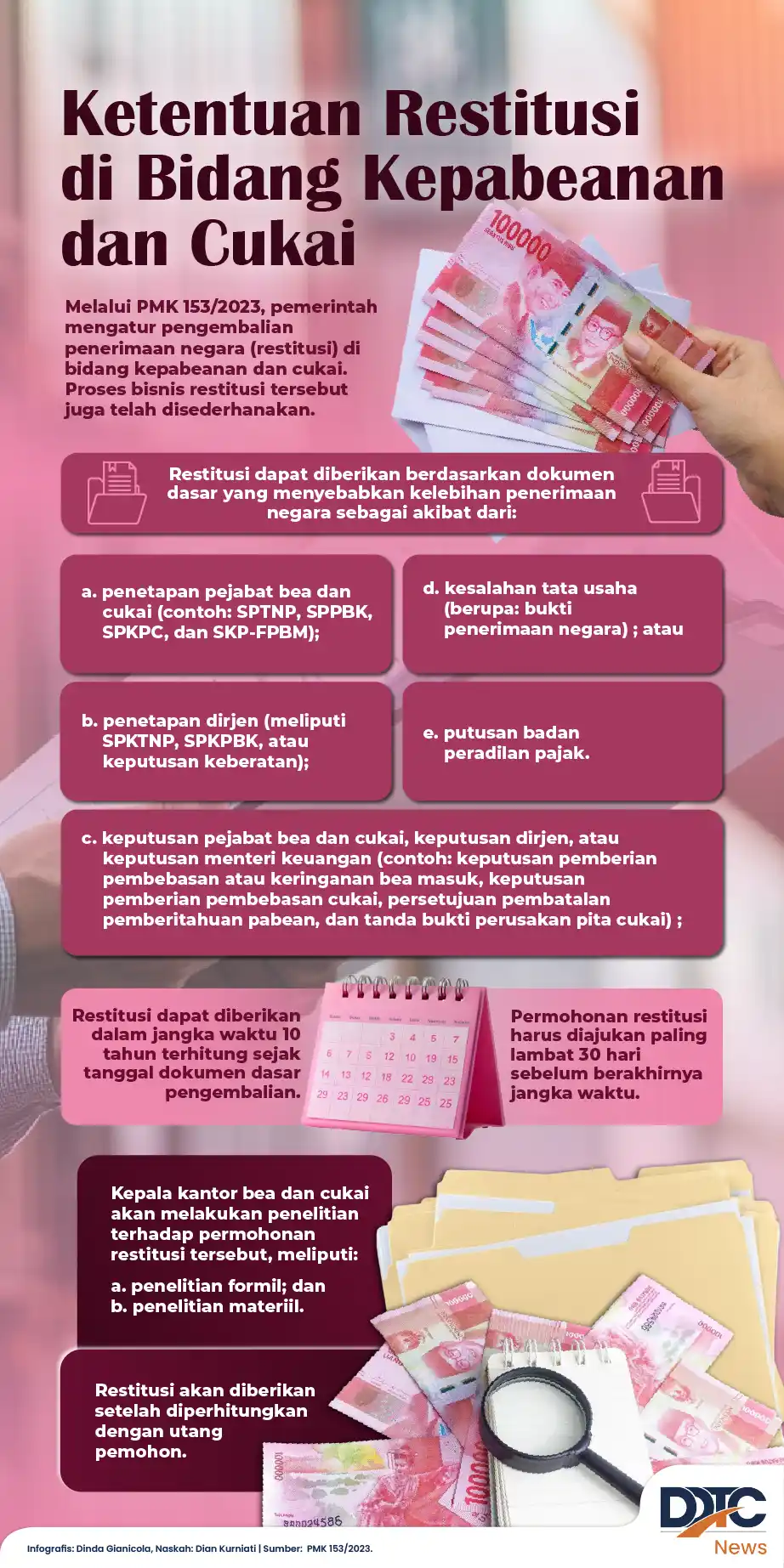

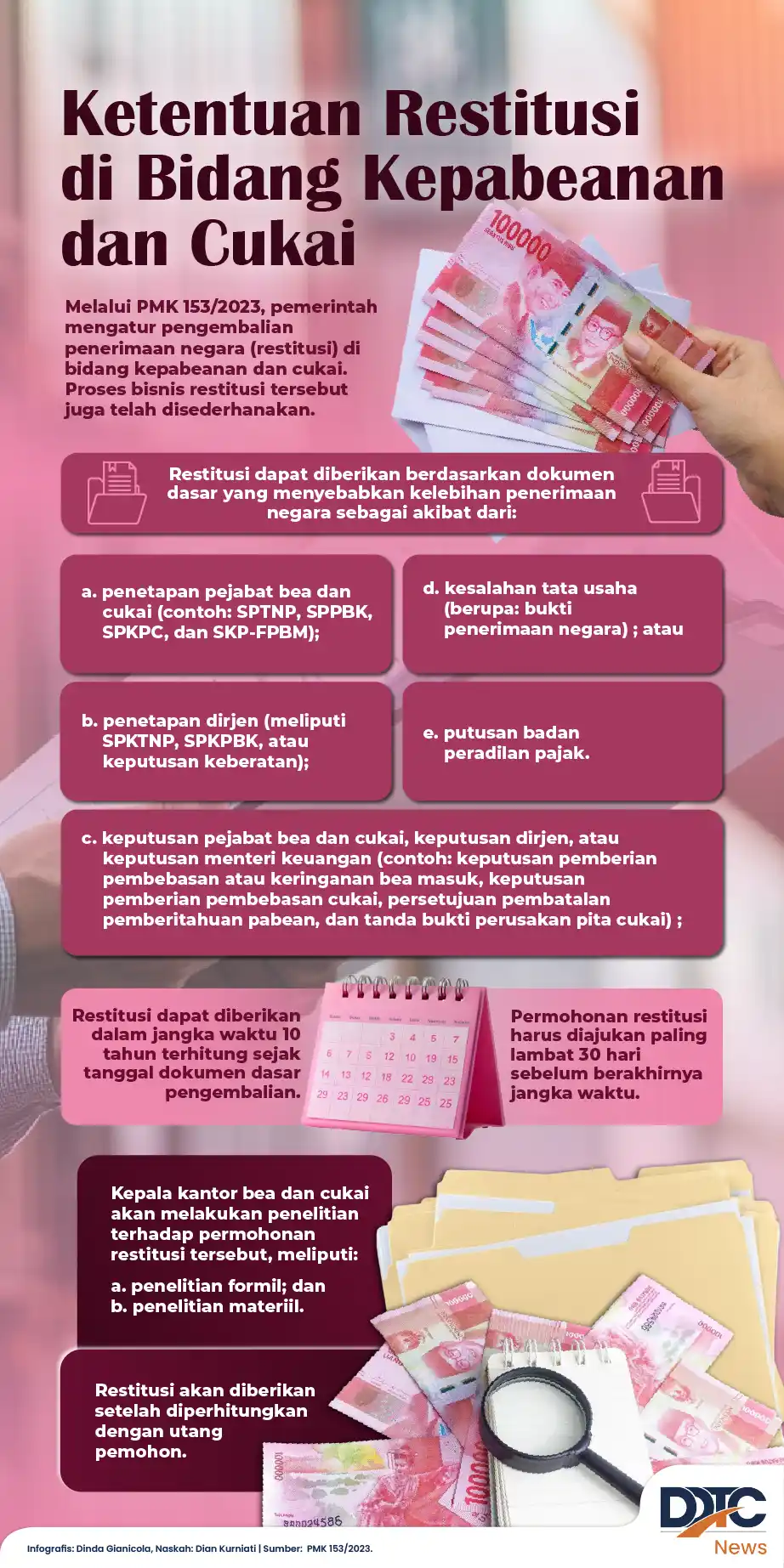

Customs and Excise Restitution Rules for Taxpayers

DJBC issues restitution rules for customs and excise effective 1 Jan 2025, with filing steps, a 3-year claim period, and settlement within 30 days.

Last updated:

DJBC issues restitution rules for customs and excise effective 1 Jan 2025, with filing steps, a 3-year claim period, and settlement within 30 days.

Minister Muhaimin Iskandar says President Prabowo will issue an Inpres for MSMEs to use idle assets, like a KAI facility, to expand market reach.

UK Finance Minister Rachel Reeves signals an income tax rate rise in the budget to be presented on 26 November 2025 to address the fiscal deficit.

PPh 21 (DTP) benefit can be used without written request if employer meets KLU criteria and employee salary is within limits of PMK 10/2025 and

South Korean lawmakers propose cutting inheritance tax to 30% and raising the exemption for owned homes, but the proposal is not in the reform agenda.

Jasa Raharja partners with 2,358 merchants to give 10% discount vouchers to 8,754 taxpayers who pay vehicle tax PKB and SWDKLLJ on time since 2023.

The Kutai Barat regional parliament created a Palm Oil Special Committee to collect at least 200 million rupiah in overdue land and building tax,

Indonesia's tax authority launches Coretax, replacing DJP Online. Taxpayers must activate, upload a photo, and get an Auth Code to file 2025 return.

Statistics Agency recorded a 5.54% rise in manufacturing output in Q3 2025, surpassing national GDP growth of 5.04%, noted by the Industry Minister.

Tax Authority: taxpayers who are not compliant with income tax will lose invoice rights, a step to improve compliance and state revenue.

The Directorate General of Taxes revokes tax invoice creation rights for taxpayers who have not fulfilled income tax, aiming to strengthen tax

DJP sends reminder email to taxpayers with unpaid taxes, stating the messages are only reminders, not active collection notices, and provides steps to