Special Tax Consultants Needed to Boost UMKM Compliance

The article highlights the need for dedicated tax consultants for Indonesia's micro, small and medium enterprises (UMKM) participating in government

Last updated:

The article highlights the need for dedicated tax consultants for Indonesia's micro, small and medium enterprises (UMKM) participating in government

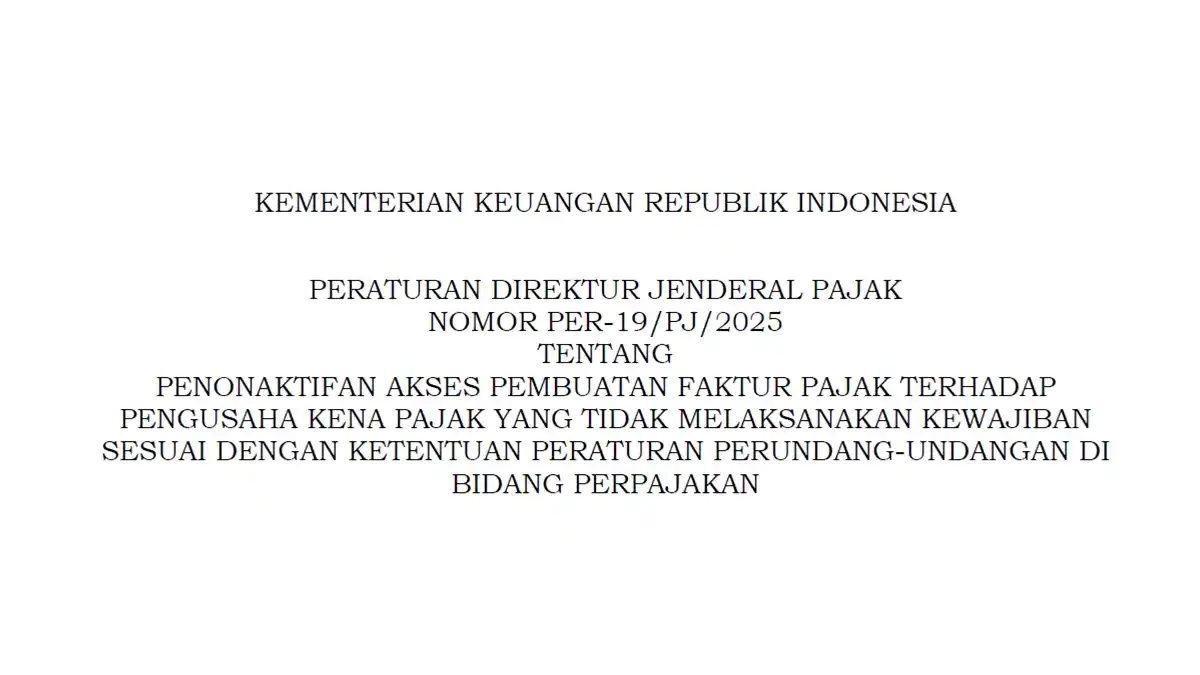

Indonesia's Directorate General of Taxation issued PER-19/PJ/2025, defining six conditions that can lead to suspension of electronic tax invoice

PT Bukit Asam posted net profit of IDR 1.4 trillion for Jan‑Sep 2025, revenue IDR 31.3 trillion, production 50.05 mt, capex IDR 3 trillion.

Probolinggo Regency gave 22.4 billion rupiah DBH CHT to about 16,000 tobacco farmers as cash assistance, meeting their right to excise revenue

Cyprus extends the 0% VAT on essential goods to December 2026 despite 0% inflation in 2025, to protect the purchasing power of vulnerable households.

CPO reference price rose to US$963.71/MT in November 2025, while export duty stayed US$124/MT; PMK 38/2024‑68/2025 also covers cocoa and pine resin.

The National Nutrition Agency caps daily MBG meals at 2,500 per SPPG, raiseable to 3,000 with certified cooks, to safeguard quality and safety.

Semarang Regency reported hotel and restaurant sector paid 33 billion rupiah tax in 2024, with hotels 11 billion and restaurants 22 billion.

15 billboards in Pekanbaru sealed for unpaid advertising tax since 2023, including three mobile‑phone outlets; the action deters non‑compliance.

Expatriates in Indonesia are classified as domestic or foreign tax subjects, which determines rates, withholding, and filing obligations for income

Government issued October 2025 tax rules, expanding the PPh 21 government-funded incentive to tourism and imposing an export duty on pine resin.

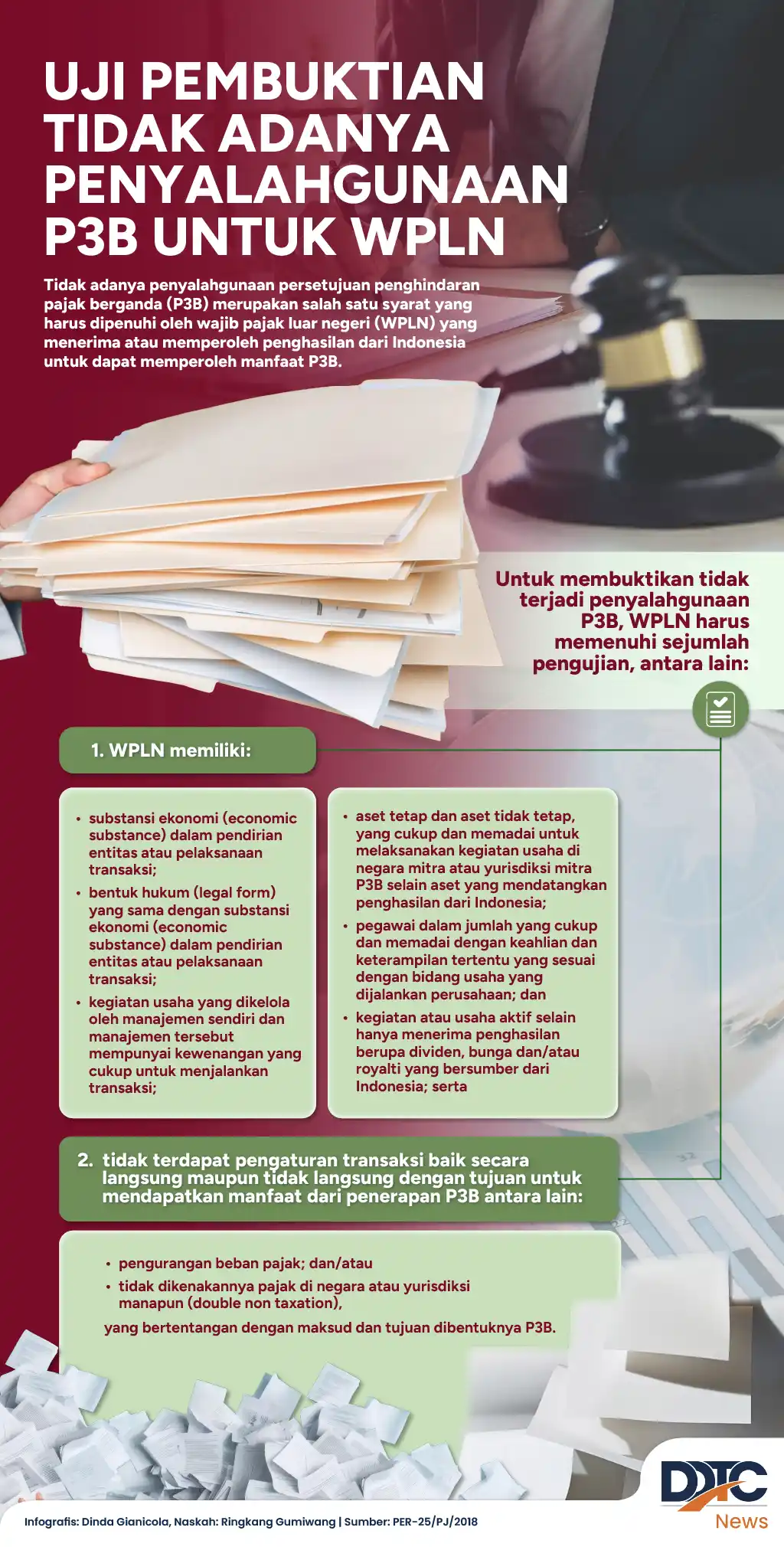

Indonesia's tax authority confirmed through verification that no misuse of the P3B mechanism occurred for foreign taxpayers, reinforcing tax