Dharmasraya Regency Cracks Down on Unpaid Advertising Tax

Dharmasraya Regency and police dismantled unpaid advertising boards, issued warnings and will enforce action if ignored, to boost local revenue.

Last updated:

Dharmasraya Regency and police dismantled unpaid advertising boards, issued warnings and will enforce action if ignored, to boost local revenue.

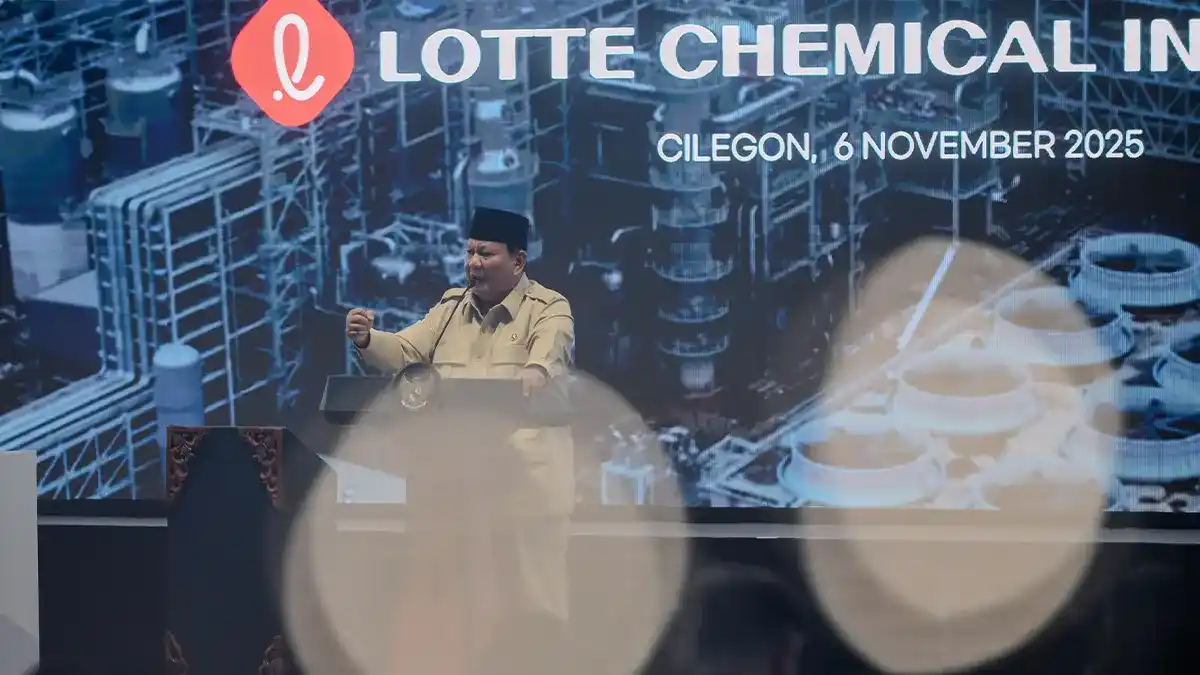

President Prabowo Subianto stressed protecting foreign investors and highlighted legal certainty and rule of law for Indonesia’s economic growth.

DJP sends reminder emails to taxpayers with unpaid taxes. This guide shows how to view the bill, create a billing code, pay, and protect from fraud.

UK will raise personal income tax by 2 points and cut social security by 2 points; budget on 26 Nov 2025 aims to stabilise economy and support NHS.

Tangerang tax office suspended all PBB services on 1 November 2025 to print 2026 SPPT in bulk; BPHTB and consultation services stay available.

Indonesia Stock Exchange reported 8.08 million investors by October 2025, a 51.2% year‑over‑year rise, with under 30 thanks to education programs.

Tax Court upheld taxpayer’s appeal, rejecting correction of the VAT base of Rp130.8 million on a June 2005 car sale; Supreme Court rejected the

The Finance Ministry is evaluating adding diapers and wet wipes to the excise tax list under the 2025‑2029 strategic plan, aiming to increase state

DDTC will hold a seminar 10 December 2025 to prepare taxpayers for the Global Minimum Tax under PMK 136/2024, covering IIR, DMTT and UTPR rules.

The Directorate General of Taxes identified 25 taxpayers who filed fictitious export reports, potentially costing the state 140 billion rupiah and

On 3 November 2025 KPP Kendari and Konawe Kepulauan held a tax filing and Coretax activation event to improve fiscal transparency for local officials.

Indonesia's Finance Ministry says tax revenue of $12.2 trillion funded revitalization of 11,600 schools by September 2025, with only 42.3% budget