Police and Finance Ministry Uncover Duty Breach in 87 Tanjung

Police and Finance Ministry uncovered duty breach in 87 containers, where goods labeled fatty matter had CPO derivatives, risking Rp140 billion loss.

Last updated:

Police and Finance Ministry uncovered duty breach in 87 containers, where goods labeled fatty matter had CPO derivatives, risking Rp140 billion loss.

The OPN Police task force urges CPO export governance after finding manipulation, under‑invoicing and DMO avoidance, calling on authorities to act.

Wonosobo Tourism Office reports tourism operators work without permits to avoid taxes; only businesses are recorded, yet regulations require

Tanah Bumbu Regency Secretariat and Batulicin Primary Tax Office held a workshop on filing the 2026 annual tax return (SPT) via Coretax for Merah

Indonesia requires domestic taxpayers meeting the Directorate General of Taxes’ criteria to submit a Country‑by‑Country Report for each jurisdiction

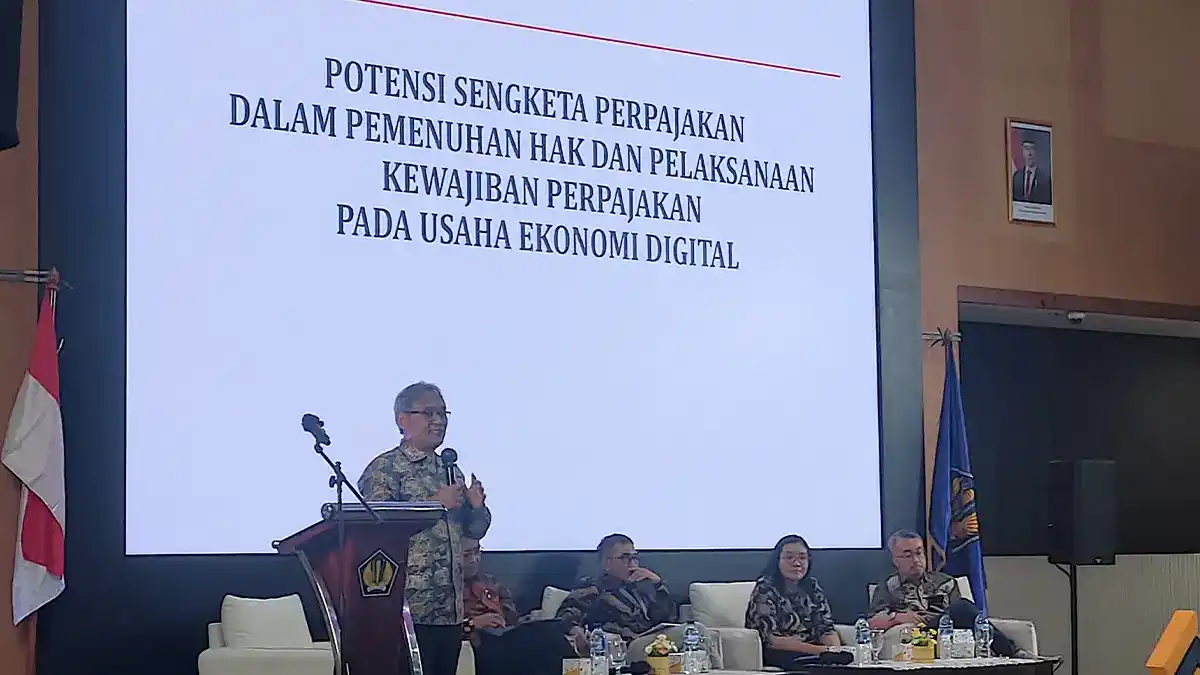

Tax Court Judge Junaidi Eko Widodo says the digital economy adds marketplaces as a third party, challenging collection and SKP issuance.

Indonesia's Customs and Excise Authority outlines registration steps for the CEISA 4.0 web portal, a customs service platform, as of 7 Nov 2025.

.jpg&w=3840&q=75)

Kutai Timur County recognized 100 taxpayers who paid regional taxes online in 2025 and organized a digital lottery with 63,352 prize numbers.

Nigeria will tax SMEs with revenue up to NGN100 million (≈Rp1.16 billion) at 0%, waive registration for 250,000 small firms, and grant VAT exemptions

Permanent staff qualify for the PPh 21 DTP tax incentive when their regular gross salary does not exceed Rp10 million; bonuses, holiday allowance or

President Prabowo inaugurated Lotte Chemical's $4.2 billion petrochemical plant in Cilegon, Banten, to boost downstream industry and cut imports.

Indonesia's Directorate General of Customs halted export of 87 containers of fatty matter worth Rp28.7 billion because the shipment did not match the