Balikpapan City Accelerates Hotel and Entertainment Tax Payments

Balikpapan City seeks Goods and Services Tax (PBJT) from hotels and entertainment before holidays by registering taxpayers and sending field teams.

Last updated:

Balikpapan City seeks Goods and Services Tax (PBJT) from hotels and entertainment before holidays by registering taxpayers and sending field teams.

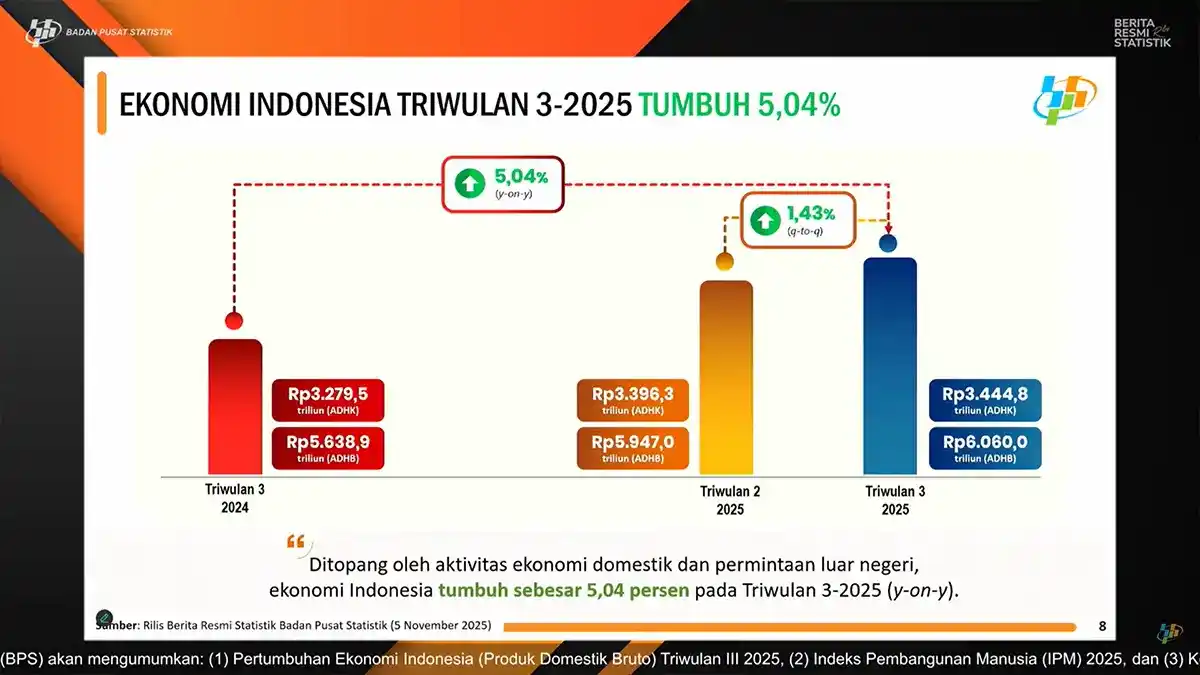

Statistics Agency reports Indonesia’s economy grew five point zero four percent YoY in Q3 2025, with GDP Rp6.060 trn and real GDP Rp3.444,8 trn.

Govt will not ban thrifting (sale of used clothing) but will push SMEs to shift to local products, tighten import monitoring and blacklist violators.

Indonesia's Central Statistics Agency reported Q3 2025 growth of 5.04 percent, led by manufacturing, near the 5.2 percent 2025 target.

Tax exchange rates for 5–11 November 2025 were set by Finance Minister Decree No. 23/MK/EF.2/2025, covering rupiah values against USD, SGD, EUR and

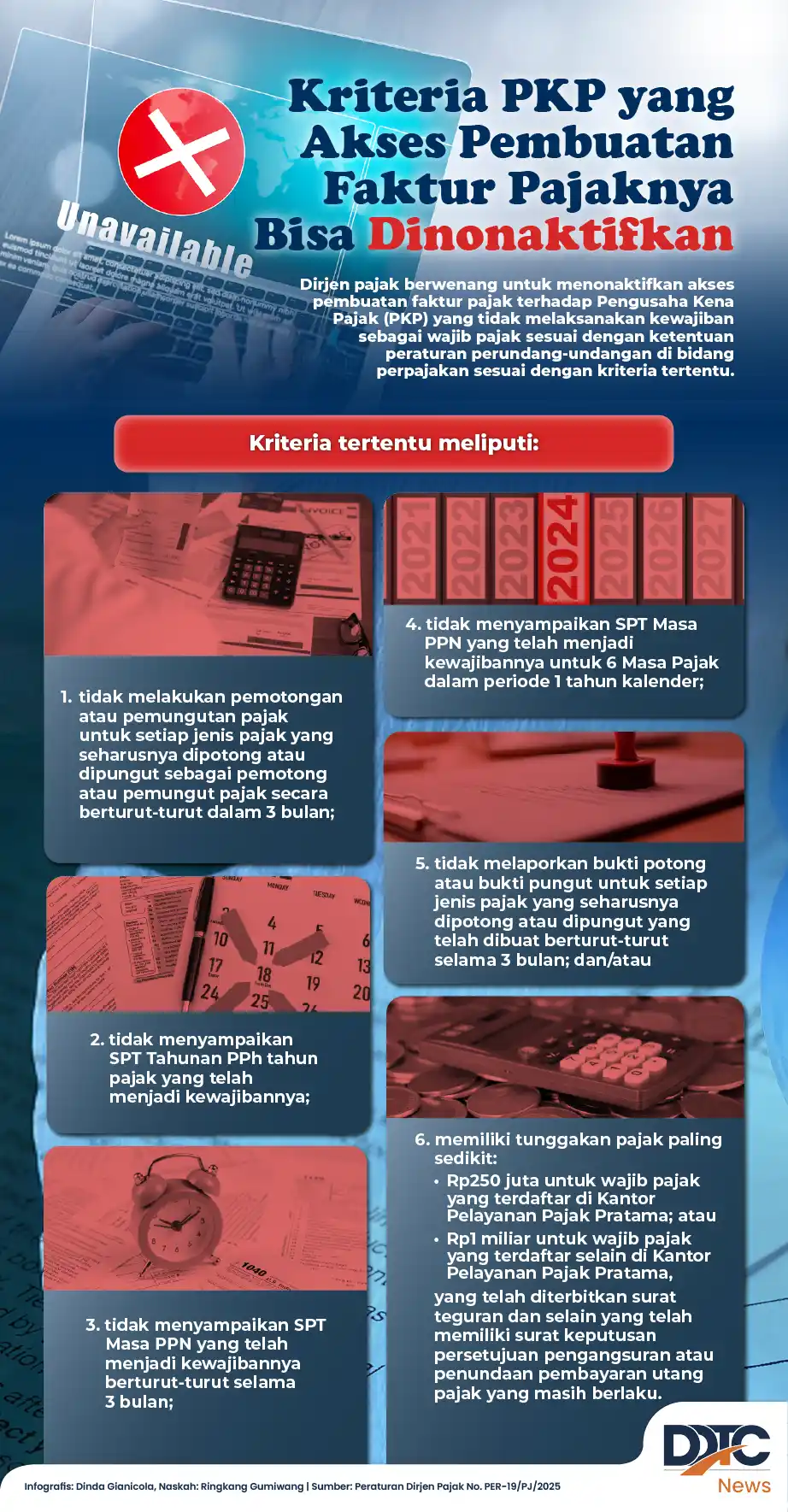

The Indonesian Tax Authority may deactivate e‑invoice access for taxable entrepreneurs who fail tax filings, have arrears, or misuse the e‑invoice

Taxpayers may use NPPN in the Annual Return, but must notify the tax directorate within three months; Coretax rejects NPPN if notification is missing.

Nigeria President Bola Tinubu announced a 15 percent tariff on gasoline and diesel imports to boost domestic fuel production, but hikes are feared.

North Sumatra tax office blocked 310 accounts totaling Rp119 billion, under Law No.19/2000 and Regulation 61/2023, to speed collection.

On 29 October 2025 in Bandung, DJP West Java I hosted the PLN Tax Forum, covering PMK 51/2025 on tax; PER‑11/PJ/2025 on PPh, VAT and stamp duty.

The tax exchange rates for 5‑11 November 2025 show the rupiah weakening against the US dollar and other major currencies, affecting VAT, luxury goods

Indonesian marketplaces prepare to collect PPh 22 on online sales despite delayed appointment of tax collectors, per PMK 37/2025 and PER‑15/PJ/2025.