Indonesia Tax Authority Calls Wealthy to Clarify Missing SPT Data

Indonesia’s Directorate General of Taxes (DGT) has summoned about 1,000 high‑wealth individuals to clarify missing SPT data, aiming to boost

Last updated:

Indonesia’s Directorate General of Taxes (DGT) has summoned about 1,000 high‑wealth individuals to clarify missing SPT data, aiming to boost

Lawmaker Novita Hardani proposes tax incentive for labor‑intensive sectors: PPh reductions, credit subsidies, and a ban on used clothing imports.

DDTC Academy and Jakarta Regional Revenue Office will hold a workshop on 15 December 2025 to guide local authorities in setting retribution targets

Director DJP: most coal miners have not paid tax because of complex groups; DJP uses risk management 27 variables, inspections.

DJBC will review extending tax stamp payment to 90 days starting 2026, echoing the 2020‑2024 Covid‑19 relief that eased cash flow for tobacco

From 10 December 2025, Tangerang City cuts BPHTB by 10 percent to lower property purchase costs and improve local tax revenue.

Indonesia’s defence minister said 80 percent of tin output is smuggled abroad, leaving the state without tax revenue and limiting PT Timah’s earnings.

On 12 November 2025, the Natar tax office visited South Lampung agencies to reinforce tax obligations and introduce the integrated Coretax system.

Indonesia's tax authority will automatically exchange property ownership data from 2029‑2030 under IPI MCAA, aiming to improve tax transparency.

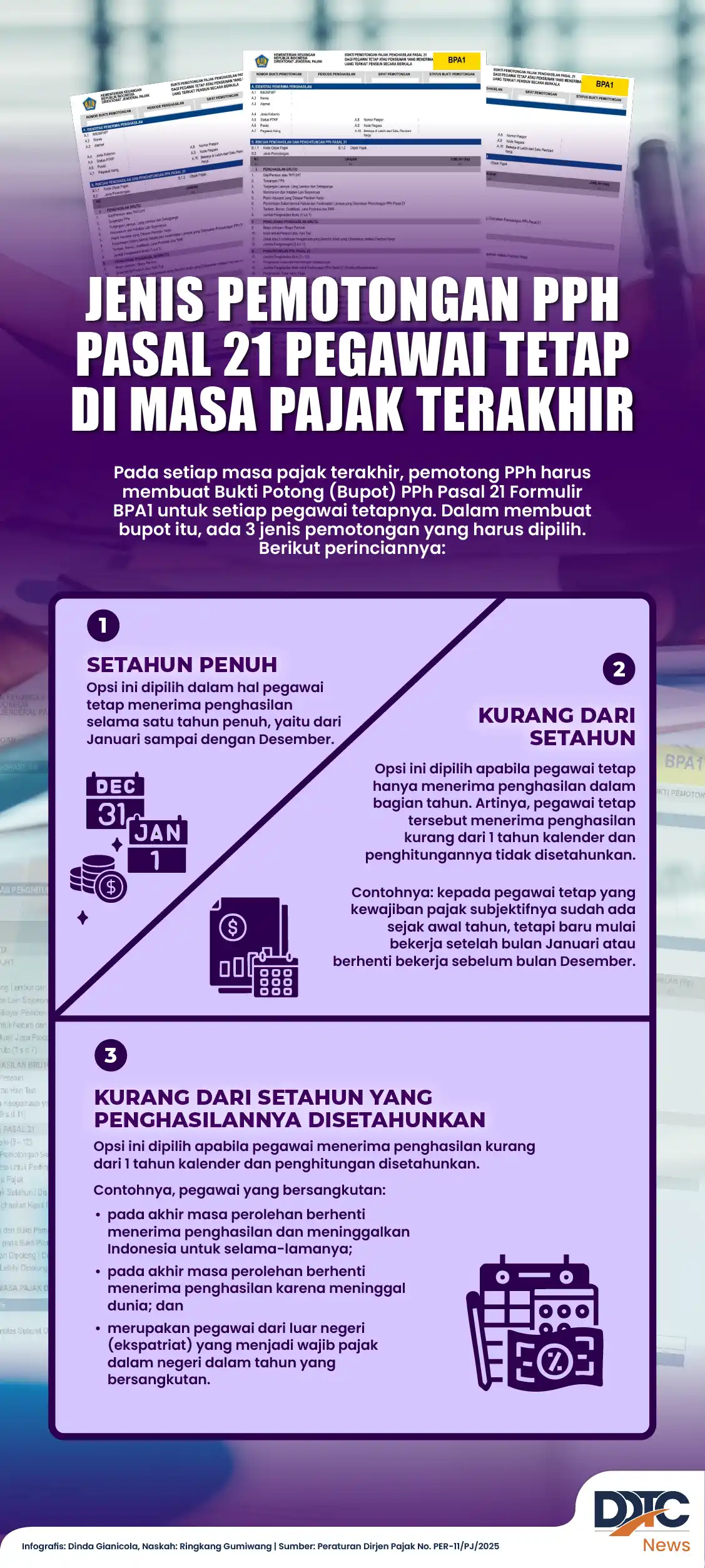

The infographic outlines three PPh 21 withholding types for permanent staff in the final tax period: regular, final and end‑year adjustment.

US Representative will meet Indonesian officials in Washington to discuss a pact cutting duties from 32% to 19% Indonesia not met its commitments.

Bali’s Homestay Association opposes the governor’s plan to halt Airbnb, urging regulation and data collection to safeguard revenue and small