Trade Minister Budi Says Basic Goods Prices Stable Ahead of

The Trade Ministry will monitor basic‑goods prices and stocks and revise Permendag 18/2024 on Minyakita distribution ahead of Christmas 2025.

Last updated:

The Trade Ministry will monitor basic‑goods prices and stocks and revise Permendag 18/2024 on Minyakita distribution ahead of Christmas 2025.

APSyFI says five textile factories will close in 2025, cutting 3,000 jobs. Dumping imports and falling capacity drive closures, raising industry risk.

Bangka Regency launches a PBB‑P2 relief program offering up to 75 % discount and full penalty waiver, effective 1‑30 December 2025, with multiple

The Financial Reporting Standards Committee of the Ministry of Finance sets, publishes, and oversees Indonesia’s accounting standards to ensure

Indonesia's Industrial Confidence Index slipped to 53.45 points in November 2025, driven by weaker production even as inventories stayed in expansion.

DJP Banten held a Coretax briefing with the network on 26 November 2025, 100 volunteers for the 2026 filing and aiming for account activation.

Deputy Chairman of Indonesia’s MPR backs the MUI fatwa, urging the ministries to exempt pesantren from PBB and donation income tax, in line with law.

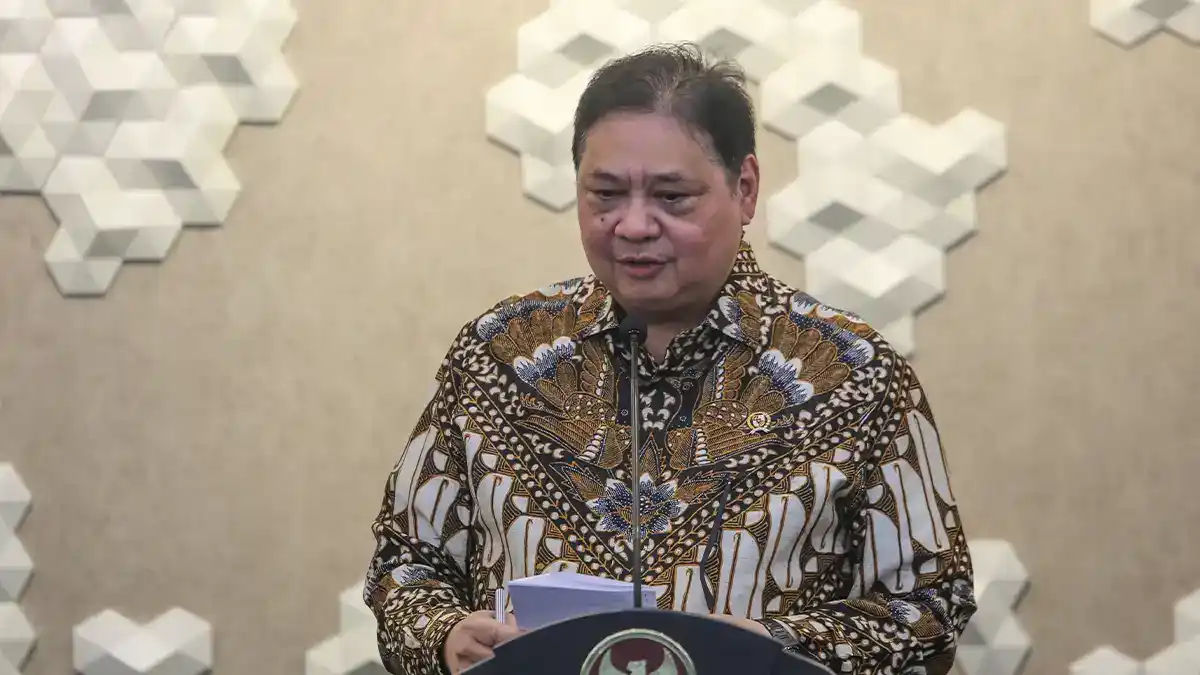

Economy Minister Airlangga Hartarto projects Indonesia’s 2026 GDP growth at 5.4%, citing fiscal incentives, lower interest rates and consumer

Estonia, via Finance Minister Jürgen Ligi, asks the EU to allow small states to skip the GloBE minimum tax, using a side‑by‑side model like the US.

U.S. President Donald Trump says he will scrap income tax, fund it with import‑tariff revenue and give a $2,000 cash dividend to each citizen.

The National Traffic Corps promotes the Signal app for digital vehicle tax payments, integrating vehicle and population data, with 13.4 million

Deputy Minister Airlangga Hartarto said 501 local governments (91.8%) have tax platforms, with QRIS and e‑banking generating Rp75.3 trillion in H1