Corporate Income Tax Receipts Fall 9.6 Percent While Gross Grows

The DGT reports corporate income tax receipts of IDR 237.59 trillion through October 2025, with gross up five point three percent and net down nine

Last updated:

The DGT reports corporate income tax receipts of IDR 237.59 trillion through October 2025, with gross up five point three percent and net down nine

Starting tax year 2025, income tax returns must be filed via Coretax. Taxpayers must activate their account, obtain an authorization code, and

DDTC, winner of the 2025 Asia‑Pacific Tax Innovator award, has upgraded its tax platform with language, MLI and region filters, bilingual search,

Indonesia's tax authority aims to wrap up audits and collect IDR 139.83 trillion in tax receivables, while finalising Coretax upgrades and preparing

Directorate General of Taxes reports VAT receipts of 277.63 trillion rupiah in October 2025, net down 25.6% due to large refunds and weak industry.

Customs officials taught traders in regions to spot illegal cigarettes, explain health risks and penalties, note impact on health, state revenue.

PPh 21 for activity participants is calculated by applying the personal income tax rate to the gross amount received, including when the participant

Indonesia's DPR will summon Finance Minister Purbaya Yudhi Sadewa to discuss the MUI tax justice fatwa, urging tax law revisions to align with Sharia.

On 19 November 2025, the Tax Office held a meeting for 137 employees, explaining Coretax registration, auth code and asset reporting under Tax Law.

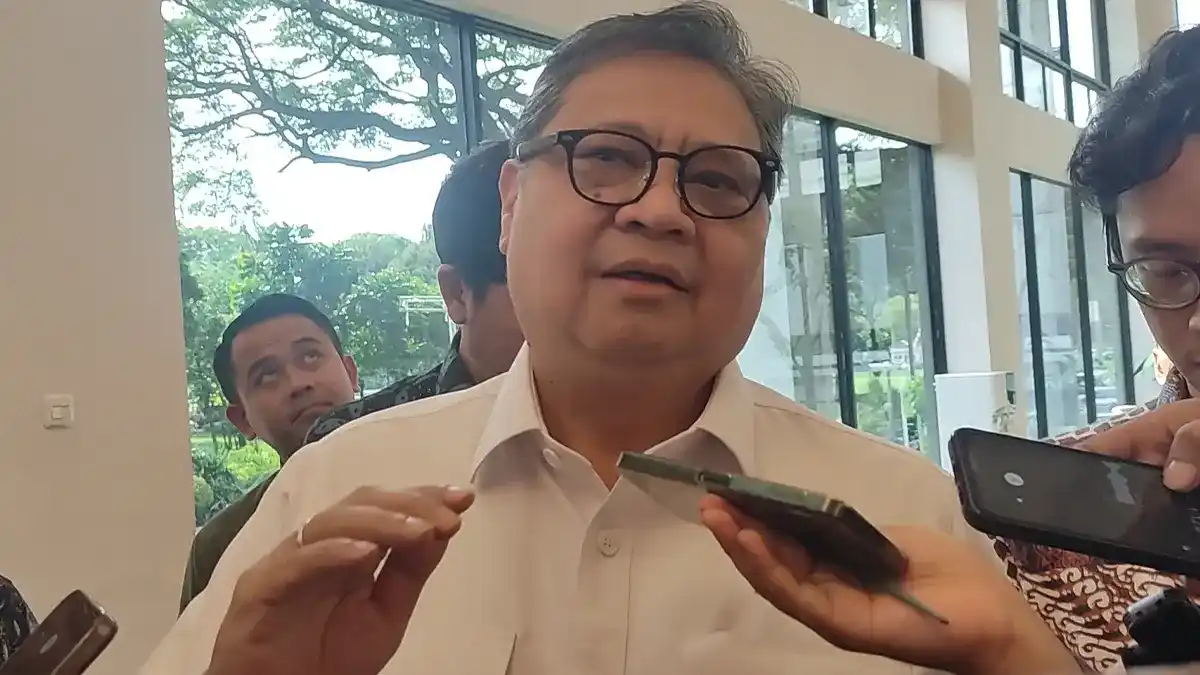

Economy Minister Airlangga Hartarto announced a 786‑billion‑rupiah stimulus for areas that curb inflation, expand services, pending Finance approval.

The East Java provincial council approved a revision of the Regional Tax and Retribution Law, postponing the heavy equipment tax to 2029 and shifting

Bogor County will waive property tax for assets under Rp100,000 through 2029, with payment Sep‑Dec 2025 and a discount for timely settlement.