Surabaya cancels PBB penalties up to forty percent BPHTB discount

Surabaya cancels all PBB-P2 penalties and gives up to forty percent BPHTB discount for transactions 1‑29 November 2025, to stimulate property sales.

Last updated:

Surabaya cancels all PBB-P2 penalties and gives up to forty percent BPHTB discount for transactions 1‑29 November 2025, to stimulate property sales.

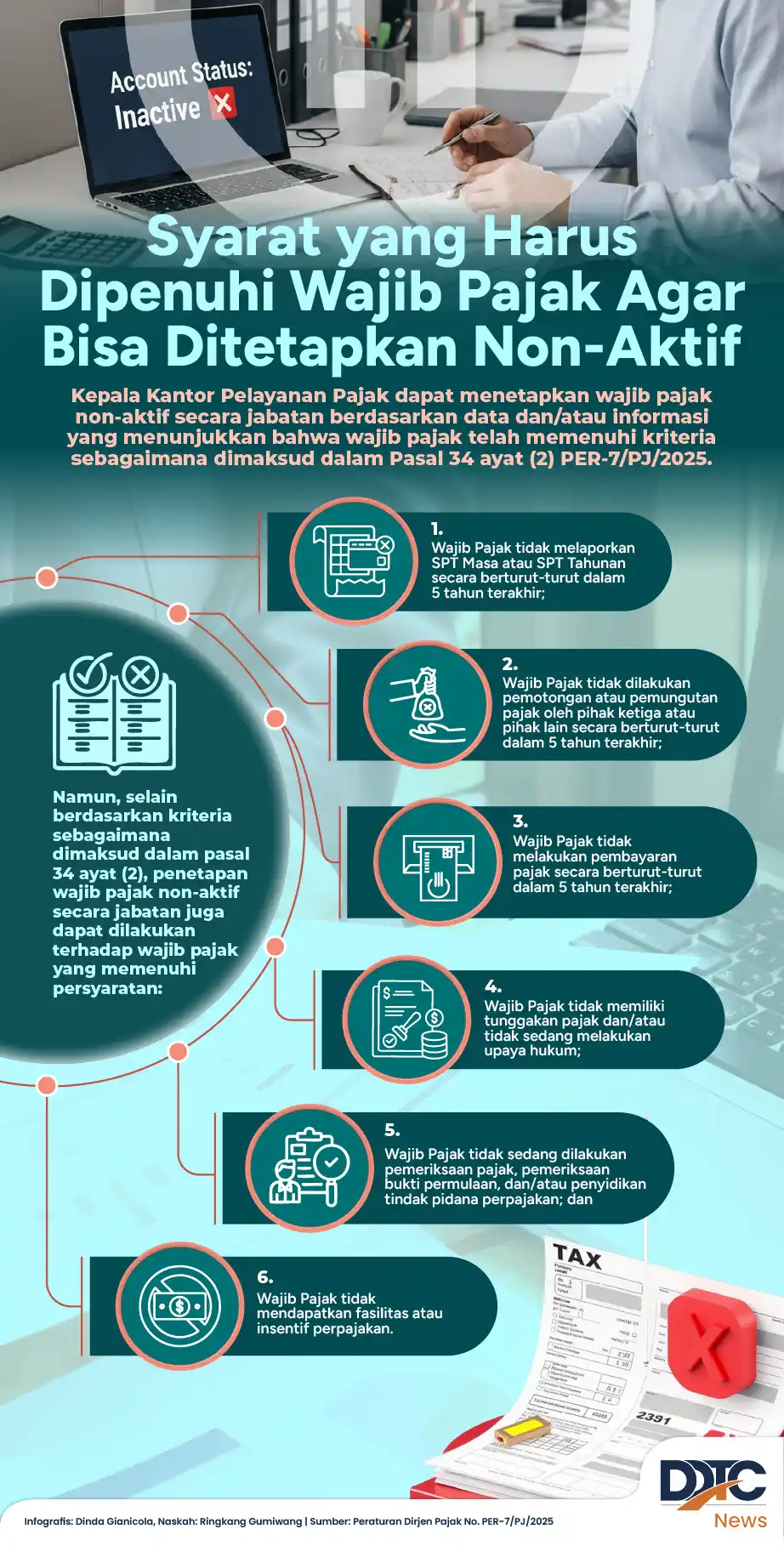

The Directorate General of Taxes sets criteria for a taxpayer to be non‑active: no taxable income, no transactions, and no SPT filing for three years.

Indonesia's household consumption rose 4.89% YoY in Q3 2025, slower than 4.91% a year earlier. The government expects stimulus and rising confidence

Book on Double Tax Avoidance Agreements details taxing‑rights priorities in US, OECD, UN, ASEAN models and effect on Indonesia’s tax revenue.

Indonesia's Customs authority issued Decision KEP‑208/BC/2025, mandating quota cuts for duty‑exempt imports via CEISA 4.0 starting 4 November 2025.

The Finance Ministry reports Indonesia's Q3 2025 GDP grew 5.04%, driven by a 4.89% rise in household consumption and a 17% jump in machinery

Nutrition Agency (BGN) reopened the kitchen partner portal on 3 November 2025 after review of applicants. Inactive proposals are deleted after 45

Members of the House of Representatives call for stimulus and tax relief to help companies avoid mass layoffs amid falling consumer demand.

The tax directorate explains permanent vs non‑permanent staff under Income Tax Article 21, per PMK 168/2023 and labor law, influencing withholding.

President Prabowo instructed the UMKM Minister to keep thrifting merchants operating by shifting sales to local goods and to speed up UMKM support via

William Bernoulli passed ADIT Paper 1 (Principles of International Taxation) and Paper 2 (Australia) in June 2025 through DDTC Academy courses.

Government will add other parties as tax collectors under Article 32A of the Tax Collection Law, such as digital platforms. PMK 37/2025 on 0.5 % PPh