Year‑End Spike in SP2DK Targets Compliant Taxpayers

Tax Director Bimo Wijayanto explains the surge in SP2DK letters is a data‑clarification tool, not a threat, while the tax authority seeks to close a

Last updated:

Tax Director Bimo Wijayanto explains the surge in SP2DK letters is a data‑clarification tool, not a threat, while the tax authority seeks to close a

PMK 70/2025 sets the 2025‑2029 Strategic Plan. DJBC issues three rules: awards, complaints, and 2026 excise stamp design.

Airlangga Hartarto says the car must cost under 300 million rupiah to be affordable, noting EV sales rose 18.27 % and may ease pressure on cars.

Employers must file Form BPA1 for the final tax period, selecting full‑year, less‑than‑a‑year, or less‑than‑a‑year with income pro‑rated.

The Tax Authority met Surakarta Education Office 19 November 2025 to launch pilot inklusi pajak di 25 SD, lebih dari 54.000 siswa.

Government will continue tax holiday and import duty exemption for vehicles for 5‑20 year investments until 2026, said Economy Minister Airlangga.

Indonesia's UMKM Ministry seeks a balanced approach to safeguard thrifting sellers while enforcing the ban on imported used clothing, aiming to

Thailand introduces tax incentives for buying energy‑efficient machines and installing residential solar panels, valid until 31 December 2028 with a

Finance Ministry’s Decree No 9/MK/EF/2025 sets five monthly interest rates of 0.51%–2.18% for tax administrative penalties 1‑31 December 2025, with

Employers withholding Income Tax Article 21 must issue BPA1 for employee salaries in December 2025 and cancel BPMP with Tax IDs before filing proof.

In the 1 December 2025 Swiss referendum, 78.3% of voters rejected a proposed 50% inheritance tax on assets above CHF 50 million, halting the plan.

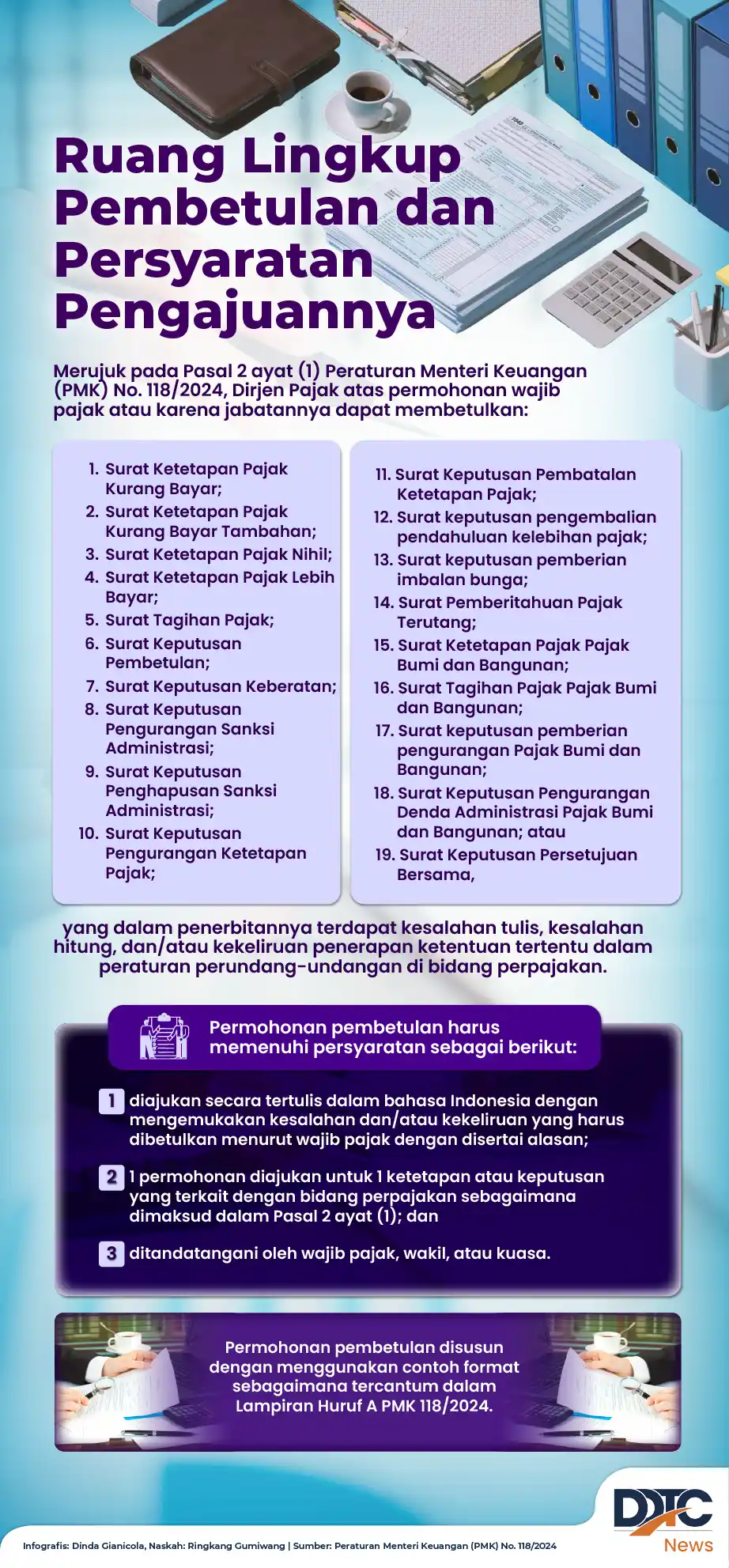

The Directorate General of Taxes issued an infographic outlining the scope of tax corrections and the documents and procedures required for filing a