Government Separates Recycling from Waste Management in KBLI

Government revises KBLI to separate recycling from waste management, clarifying classification and supporting green industry and economic shift.

Last updated:

Government revises KBLI to separate recycling from waste management, clarifying classification and supporting green industry and economic shift.

Donations for national disaster relief can reduce a taxpayer’s taxable income by up to five percent of the prior year’s net fiscal income, provided

Cyprus, an island at the Europe‑Asia crossroads, applies a 12.5% corporate tax, progressive personal income tax and a 19% VAT with reduced rates.

The UK government will keep the personal allowance at £12,570 until April 2031, adding roughly 700,000 taxpayers in FY 2030‑31 while maintaining

The Coordinating Minister for Economic Affairs stresses high‑quality investment in Indonesia‑China economic ties, covering technology, energy and

Kapuas Regency tax office launches a tax rally, offering refrigerators, washing machines, electric bikes, and motorcycles to compliant taxpayers.

The 2024 DJP Annual Report recorded 112 tax crime cases, of which 59 (53%) involved filing false tax returns, making it the most common modus

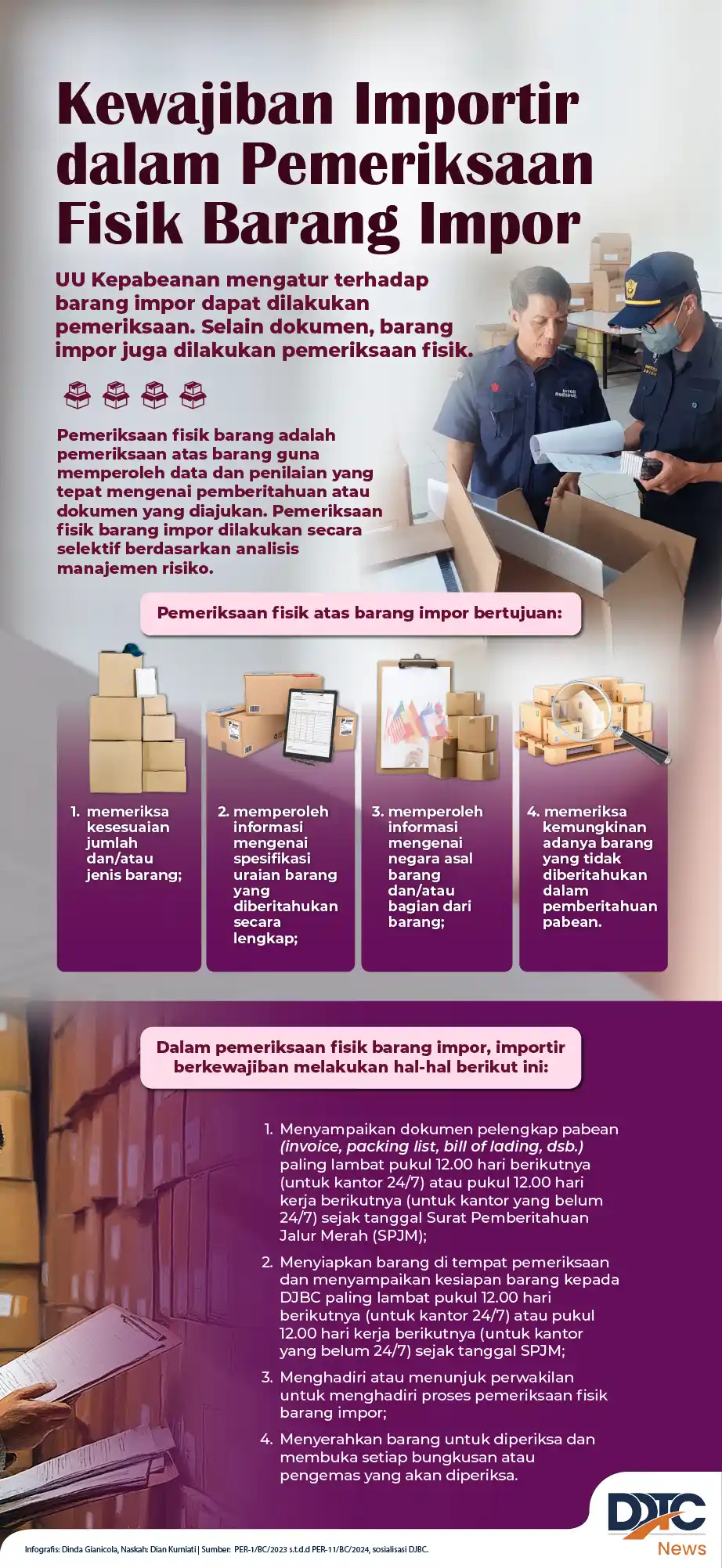

Importers must provide documents, allow access, and cooperate with customs during inspection of goods to ensure compliance and avoid penalties.

Bank Indonesia said reserves reached US$150.1 billion in November 2025, up from US$149.9 billion October, due to tax receipts and external borrowing.

Police Task Force OPN, with Tax and Customs Directorates, urges palm‑oil firms to follow tax rules after detecting under‑invoicing of CPO exports.

DDTC Academy conducted a course on humor, empathy, and rhetorical techniques for tax audits and negotiations on 4 Dec 2025, training 21 professionals.

Eswatini will waive VAT on medical supplies, feminine pads and related items from 1 January 2026 to lower household costs.