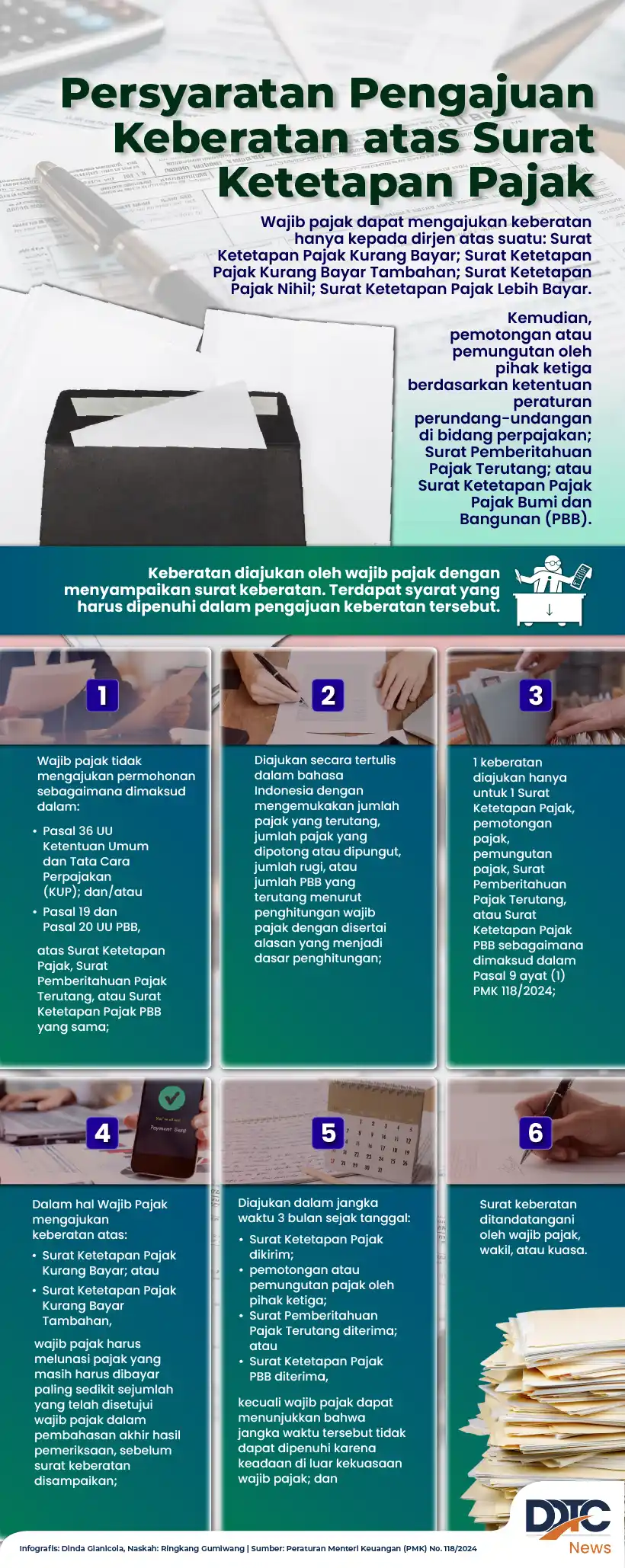

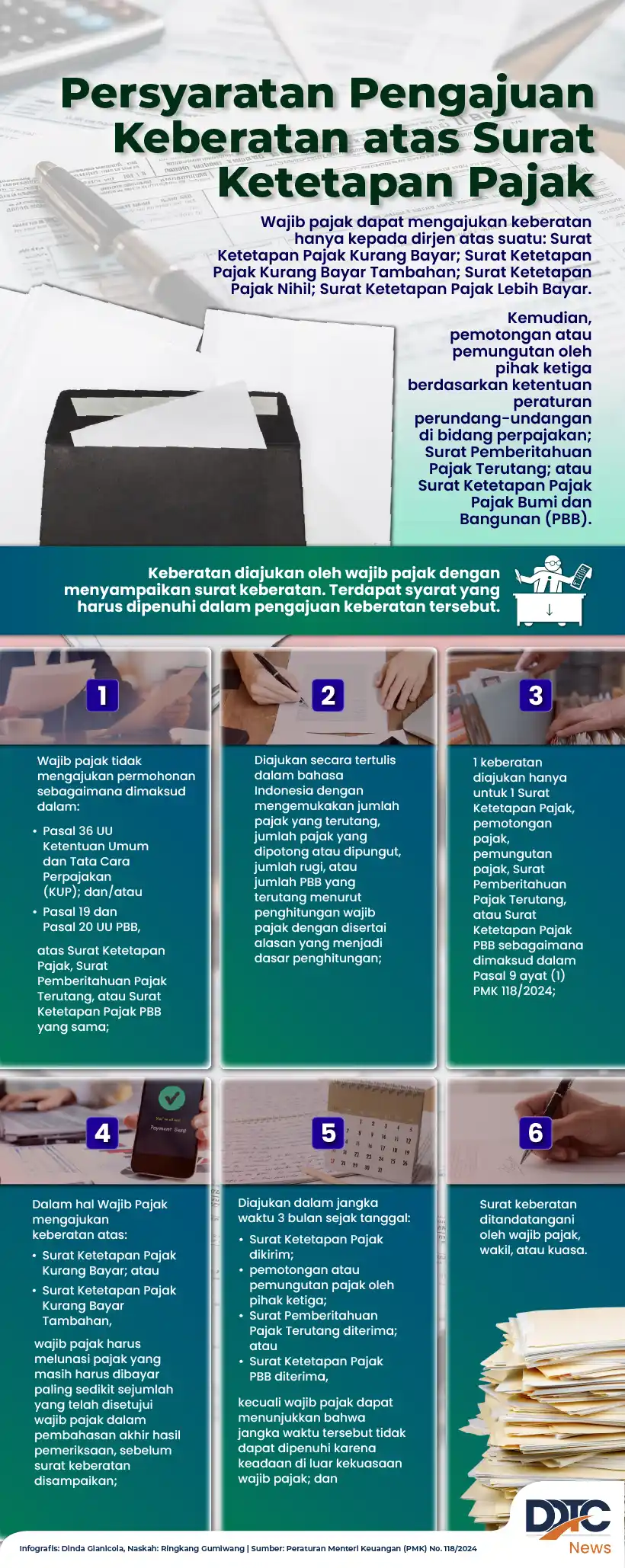

Requirements for Filing an Objection to a Tax Assessment Notice

An objection to a Tax Assessment Notice must include a formal letter, a copy of the assessment, identity proof, and be filed within 30 days of

Last updated:

An objection to a Tax Assessment Notice must include a formal letter, a copy of the assessment, identity proof, and be filed within 30 days of

Directorate General of Taxes speeds 2025 tax arrears collection via email reminders, account blocks, and cooperation with law‑enforcement agencies.

The tax authority uses CRM data to select audit triggers like refunds, three‑year losses, or method changes. Taxpayers should ready documents.

Indonesia's Finance Ministry attributes the 2025 tax refund surge to a two-year payout delay, with Rp340.52 trillion disbursed between January and

Dominica proposes waiving VAT on 26 essential items, such as cod, onions, beans and household products, to ease the cost burden on consumers.

Taxpayers with dollar bookkeeping must settle PPh 25 in dollars; a payment in rupiah cannot be reallocated and must claim a refund through Coretax.

Finance Minister Purbaya says Coretax will be fully under government control by 15 Dec 2025 after upgrades, load testing and staff training.

IKA Prasmul and its Alumni Network hosted a Coretax SPT training with RDN Consulting and the South Jakarta DJP office, guiding taxpayers on account

The government delays UMKM financial reporting via FRSW until late 2025, while firms are required under Decree No 43/2025 to boost transparency.

By October 2025, Papua’s tax revenue reached Rp2.93 trillion, or 49.08 percent of the target, due to slowing economic activity and fiscal changes.

DDTC Academy held a hybrid two-day course on 26‑27 November 2025 on filing income tax returns for FY 2025 under PER‑11/PJ/2025, with 84 participants.

Finance Minister Purbaya Yudi Sadewa said Indonesia's economy grew 5.04 percent in Q3 2025 during a DPR meeting, noting stimulus and spending.