10,000 Bekasi City Civil Servants Owe Vehicle Tax

Bekasi municipal authorities report that about 10,000 city civil servants have outstanding vehicle tax; the regional revenue office urges verification

Last updated:

Bekasi municipal authorities report that about 10,000 city civil servants have outstanding vehicle tax; the regional revenue office urges verification

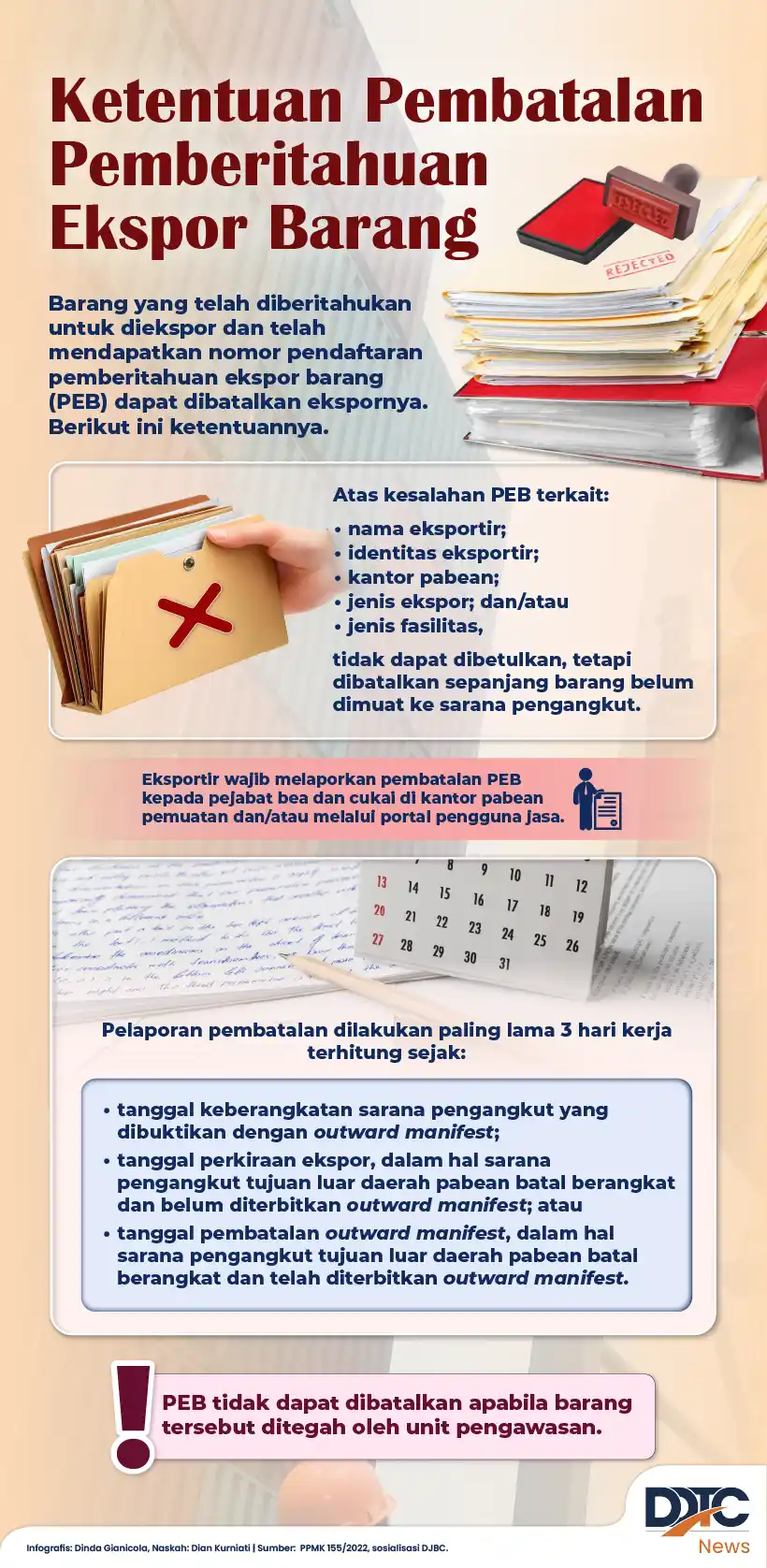

Indonesia's Customs Authority outlines export notification cancellation steps, cases, required documents, deadline and penalties for exporters.

DDTC released its 40th book, *Tax Reform Ideas: Safeguard Economy, Secure Revenue*, featuring 40 top articles and a free PDF to help close tax

Tax Director Bimo Wijayanto says minerba and palm‑oil taxes remain suboptimal; the government created Satgas PKH to impose fines and revise tax rules.

Bolivia’s President Rodrigo Paz rencanakan hapus empat pajak, termasuk pajak kekayaan dan pajak transaksi keuangan, untuk kurangi beban dan defisit.

DJBC says no tobacco tax‑stamp hoarding in 2026 as CHT and HJE rates stay unchanged, and it has printed 25 million stamps for tobacco and alcohol.

Bangka Belitung province collected IDR 622 billion in taxes by early December 2025, reaching 92.43 percent of the 2025 target of IDR 673 billion.

The Ministry of Social Affairs urges BLTS recipients to spend Rp900,000 cash aid on needs, not on cigarettes, motorbike credit or online gambling.

Indonesia's tax office flags coal arrears; sugar‑drink excise can be applied in 2026 if economic growth tops six percent.

The Directorate General of Taxes urges taxpayers to retain data for compliance checks, highlighting unpaid coal taxes, illegal used‑clothing imports,

Tax reform book launches with 40 essays covering salty food excise, special economic zone incentives, and collaborative tax compliance approaches.

DDTC hosted a contributor meeting for its 40th Tax Reform Ideas book in Jakarta on 12 December 2025, recognizing 40 authors selected from a national