Tax Incentives for BPI Danantara’s Corporate Restructuring

The Finance Ministry will grant a 2‑3‑year tax incentive for BPI Danantara’s restructuring under Article 89A of the State‑Owned Enterprises Law, while

Last updated:

The Finance Ministry will grant a 2‑3‑year tax incentive for BPI Danantara’s restructuring under Article 89A of the State‑Owned Enterprises Law, while

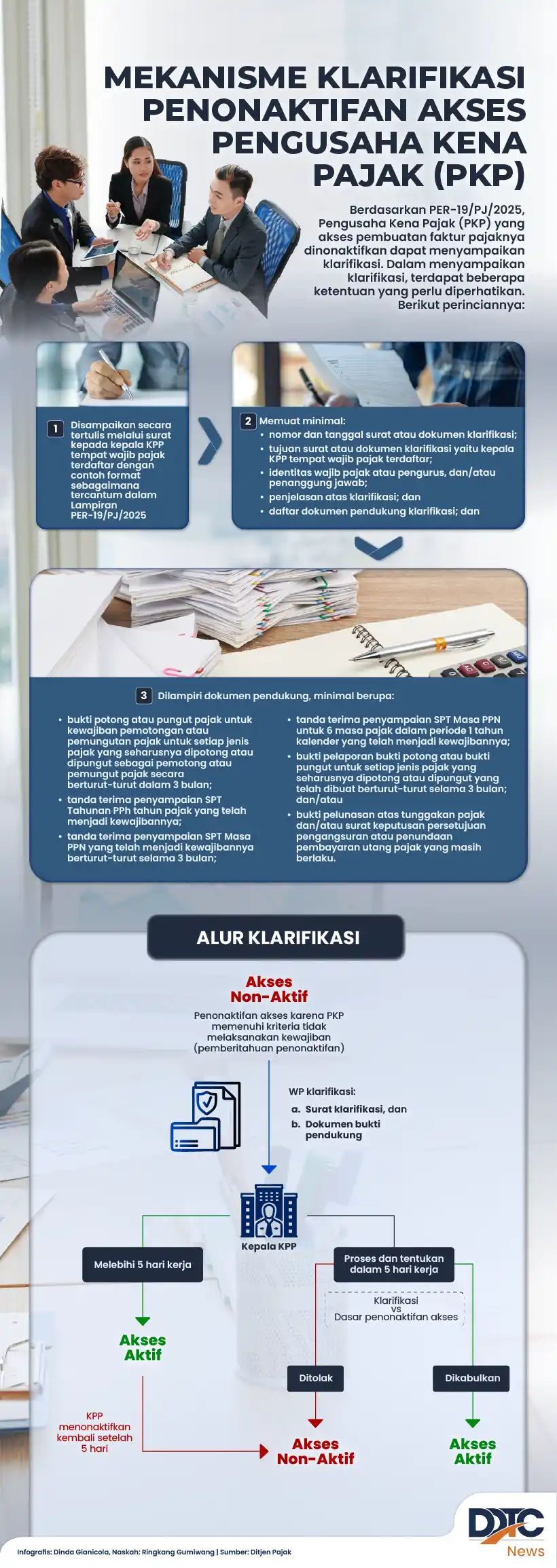

The Directorate General of Taxes released a clarification mechanism for taxable entrepreneurs whose PKP access is deactivated, outlining submission

On 13 Nov 2025, KPP Pratama Kotabumi and KP2KP Menggala held a Coretax briefing, urging matching email and phone and a valid DJP code for tax filings.

The Tax Court rejected an import‑price correction in a transfer‑pricing dispute, highlighting the tax‑customs gap and audits for taxpayer certainty.

KP3SKP asks USKP candidates IV/2025 who missed because force majeure to submit an explanation by 5 Dec 2025 12:00 WIB, to avoid 3‑period penalty.

Mauritius will levy a 15% VAT on foreign digital services via PMSE from 1 January 2026, and providers with revenue over MUR 6 million must register.

The government, led by Coordinating Minister Airlangga Hartarto, introduced ticket and shopping discounts to boost household consumption in Q4 2025.

QDMTT remains enforceable despite the G‑7 tax pact; DJP recorded 627 gratuity reports worth Rp961.73 million and appointed five foreign firms as

Indonesian Tax Authority submitted 627 gratuity reports for 2024 to KPK, about 962 million rupiah, up from 491 reports last year.

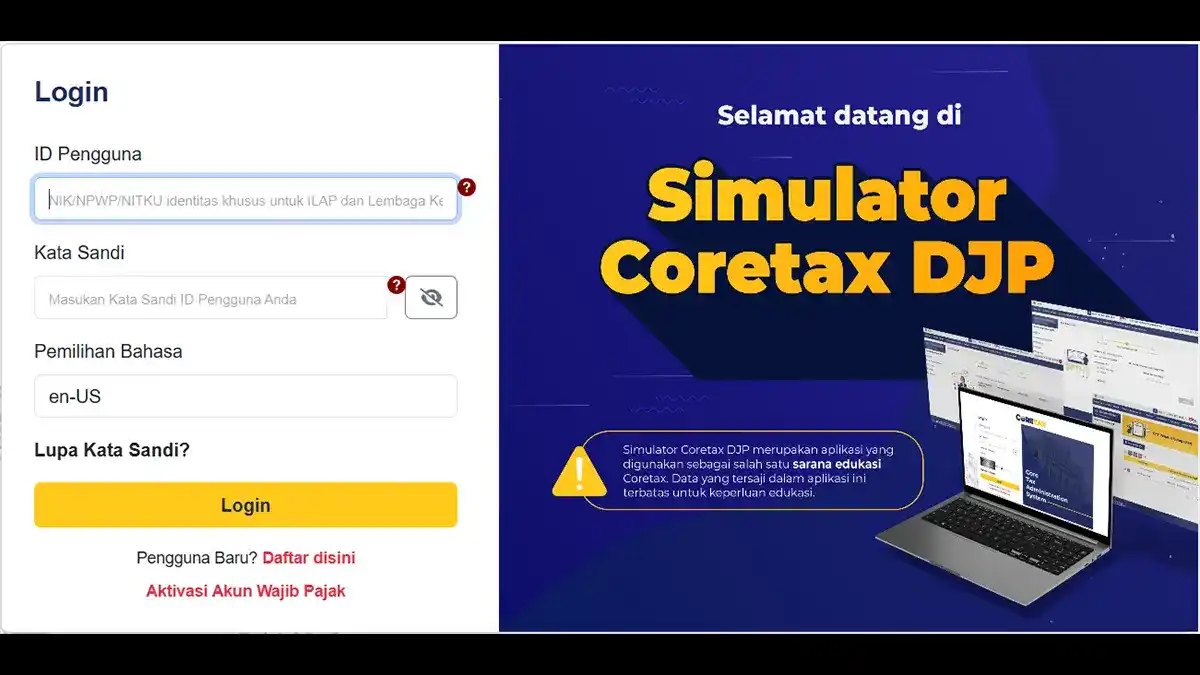

Indonesia’s tax authority has launched the Coretax Simulator, an online tool that lets taxpayers practice filing the 2025 corporate and individual

The electronic receipt (BPE) for filed SPT remains downloadable in Coretax. Taxpayers should access the My Portal or Notification menu and refresh if

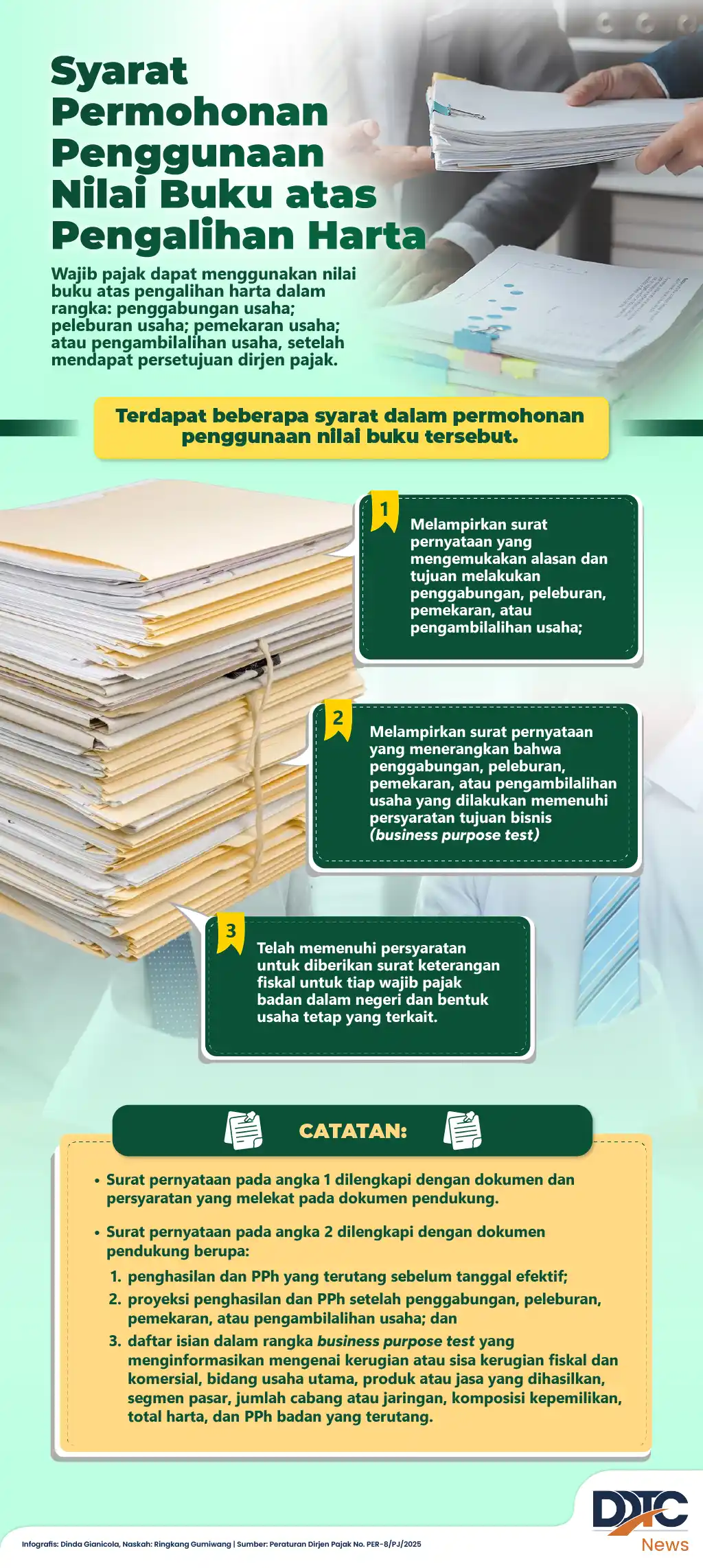

Article outlines the filing requirements for applying book value in asset transfers, including documents, deadlines, and tax verification procedures.