Purbaya Calls Coal VAT Refund a Government Subsidy

Finance Minister Purbaya Yudhi Sadewa called the coal VAT refund a subsidy and proposed a 1‑5 % export levy from 2026 to raise about IDR 20 trillion

Last updated:

Finance Minister Purbaya Yudhi Sadewa called the coal VAT refund a subsidy and proposed a 1‑5 % export levy from 2026 to raise about IDR 20 trillion

Indonesia's Commission XI approved a Rp14.41 trillion state capital injection for four firms and the Land Bank to boost transport and housing.

Blitar Regency waives administrative penalties for local tax arrears 1994‑2025, effective 4‑30 December 2025, to boost revenue and ease taxpayers’

The Indonesian Tax Authority announced that Coretax will be unavailable on 9 Dec 2025 from 11:00 to 12:00 WIB for system capacity maintenance.

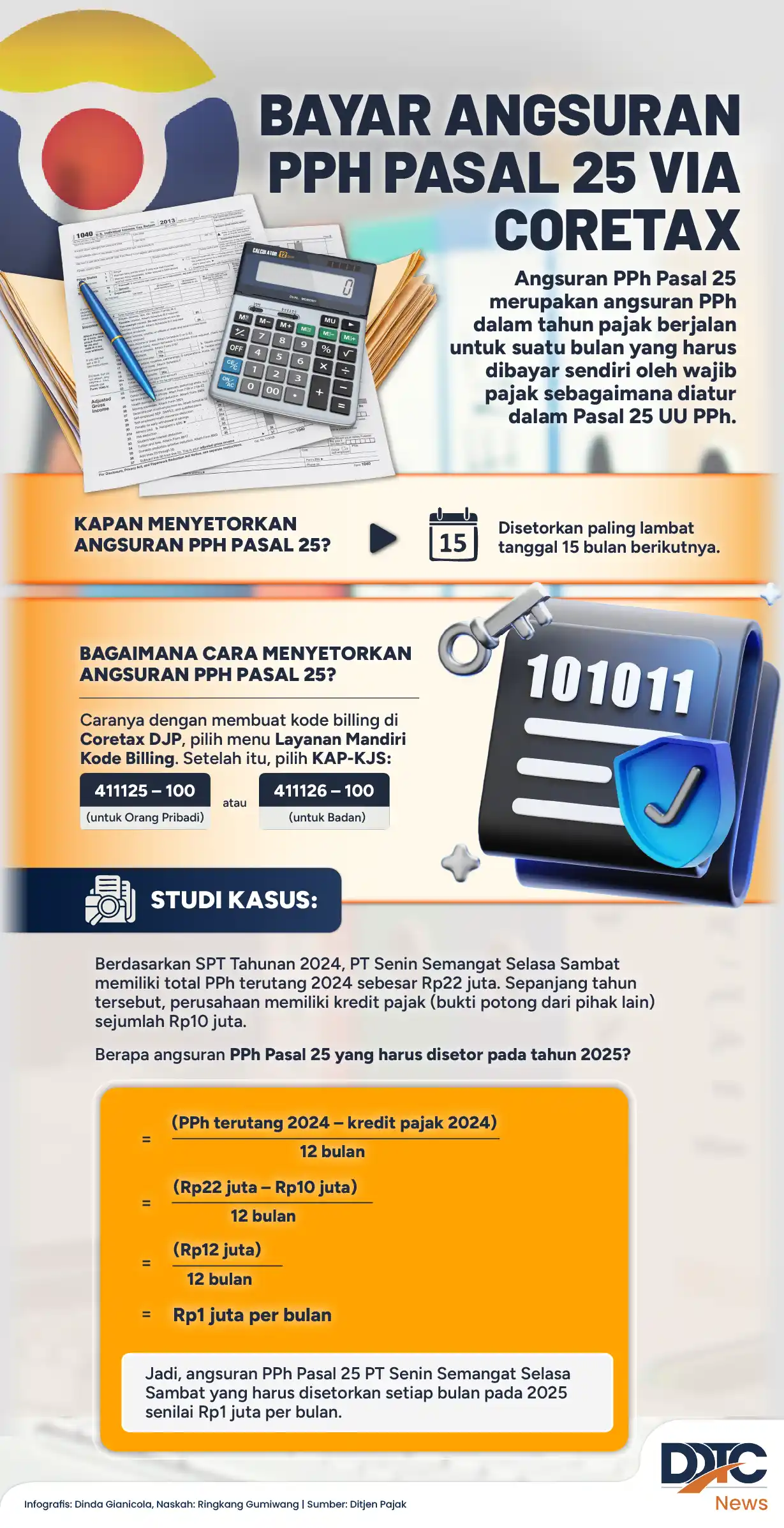

The Directorate General of Taxes introduces Coretax, a platform for PPh Article 25 installment payments, simplifying the process and reducing effort.

Travel, accommodation, and document‑preparation costs for Indonesia’s OECD accession will be funded from the state budget, with the process aimed to

Indonesia's Directorate General of Taxes issued PER-21/PJ/2025, defining three complaint types, effective 28 November 2025, replacing earlier rules.

On 18 Nov 2025 in Malang, a seminar briefed creative economy about tax duties: NPWP, bookkeeping, calculation, payment, and filing SPT via Coretax.

The government postpones the sweetened‑drink excise, considers a coal export levy due to large VAT refunds, and delays carbon tax until carbon‑market

Finance Minister Purbaya Yudhi Sadewa said a tax on sweet drinks (MBDK) could start 2026 if economy grows 6%, aiming IDR 3.8‑7 trillion budget

Finance Minister says classifying coal as taxable goods cut revenue by about IDR 25 trillion, prompting an export duty from 2026 to address the budget

Kring Pajak reminds that job expense deduction for employees is limited to five percent of income or six million rupiah per year, PMK No.168/2023.