Cooperative compliance gives special treatment to compliant

Cooperative compliance shifts from confrontation to collaboration, offering special treatment to compliant filers and using mitigation instead of

Last updated:

Cooperative compliance shifts from confrontation to collaboration, offering special treatment to compliant filers and using mitigation instead of

Decree No. 391.K/MB.01/MEM.B/2025 sets per‑hectare fines for nickel, bauxite, tin and coal mining in forest areas, to be enforced by the task force.

IKN Authority launches legislative and judicial complex project, signing eight contracts worth IDR 12 trillion for Phase II, aiming for 2028

Indonesia's tax authority sees illegal mining as a challenge for mineral and coal oversight, and flags group, transfer‑pricing risks that cut revenue.

The EU will levy a €3 import duty on e‑commerce parcels valued under €150 from 1 July 2026, targeting the surge of low‑cost shipments from China.

Coordinating Minister Airlangga Hartarto says special economic zones in Batang and Kendal raised growth to about 9% and created jobs, highlighting

Indonesia’s ETKI Special Economic Zone in Banten is ready to operate, offering duty exemptions, import tax waivers, tax relief and streamlined

Indonesia's Customs Agency is confident of meeting the Rp336 trillion 2026 revenue target by adding export duties on gold and coal, even though

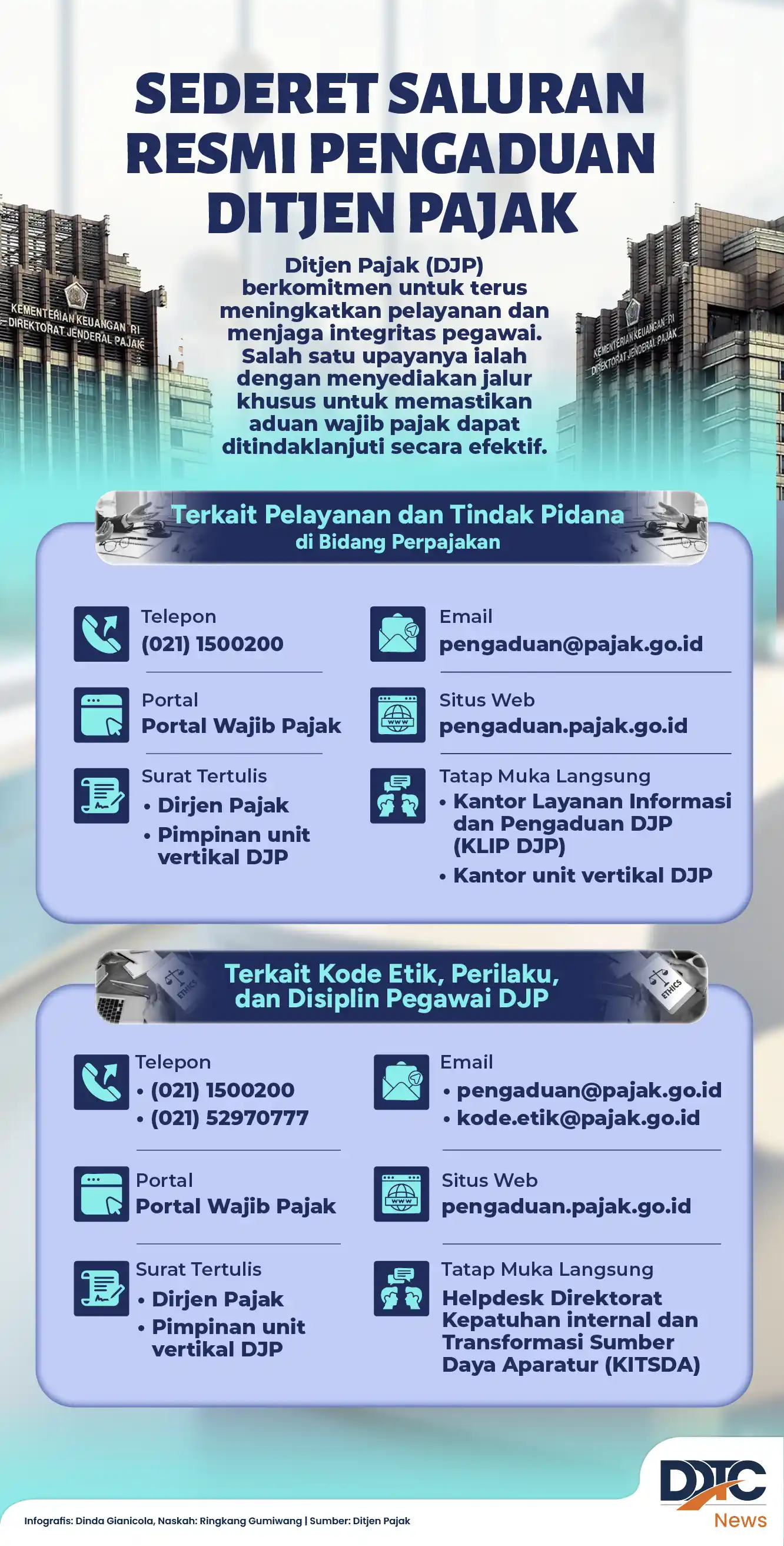

Ditjen Pajak has launched official complaint channels via an online portal, telephone service and tax offices, available from 14 December 2025.

The Finance Ministry pledged APBN funding and transfers to speed recovery in Aceh, North Sumatra, West Sumatra and other disaster areas.

Central Sulawesi province held two vehicle tax‑waiver phases in 2025, raising a total of Rp115.61 billion from motor vehicle tax and name‑transfer

Economy Minister Airlangga Hartarto notes positive business sentiment, 24 IPOs this year, a 5.4% growth target for 2026, and outlines year‑end